Against the current economic backdrop of higher inflation and heightened recession risk, investing in long-term care facilities offers a measure of stability—along with a healthy dose of positive impact. We sat down with Lenka Martinek, managing partner at Sustainable Market Strategies, who explains why healthcare REITs are poised to benefit from structural, long-term-demand growth driven by aging populations in developed markets.

What is the main thesis for investing in senior care living?

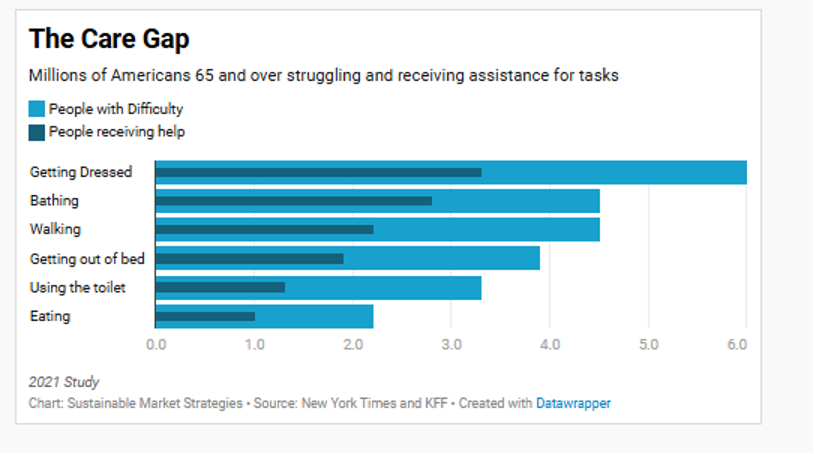

As is now well understood, the world’s population is getting older, and that’s especially the case in developed countries. Across Europe and North America, the share of persons aged 65 and older will reach 25 per cent by 2040.

The baby boomer generation is living longer and spending more years in senior age, and this trend is spurring greater demand for independent and assisted living, as well as residences offering higher levels of care. In many jurisdictions, the supply of senior housing is simply not keeping pace with demand. In Canada, Mark Carney’s newly elected government recognizes this reality and has made long-term facilities a focal point of its nation-building plan.

Beyond the demographics, investors should find this sector particularly appealing given the current global macroeconomic uncertainty. Since senior living facilities are largely domestic operations, they are far less vulnerable than other economic sectors to tariffs and supply chain challenges.

How does an investor gain exposure to this sector?

The simplest way is through real estate investment trusts (REITs). Senior care REITs own and manage assets such as independent living facilities, assisted living facilities and skilled nursing facilities. In addition to less cyclical demand, REITs are relatively insulated from rising operational costs, which are mainly borne by their tenants, and they benefit from stable rental income and inflation passthrough in their lease agreements. Many eldercare REITs also offer attractive dividend yields. Within the REITs segment, there are two major and distinct business models, and they each offer different risk-return profiles for investors:

- Triple-net lease: Commonly used for skilled nursing facilities, this structure minimizes exposure to operational costs. The REIT leases the facility for a fixed rent and the operator assumes full responsibility for the three main expenses: taxes, maintenance and insurance, in addition to operational costs. This model provides predictable, stable income and insulation from rising operating costs, but limits exposure to revenue growth.

- Senior housing operating portfolio (SHOP): In contrast, the SHOP model enables the REIT to share in revenue growth by partnering with operators who manage the facilities. In addition to rental income, the REIT is exposed to revenue from resident fees, services and amenities, but the landlord also pays more of the property expenses. This model offers more upside potential, but also greater volatility.

Though we expect senior care to benefit from strong, non-cyclical demand growth, the ability to choose between these two models—more growth-oriented SHOP or stable-income triple-net—gives investors flexibility in tailoring their exposure based on risk appetite and market outlook.

What drives the performance of senior care REITs?

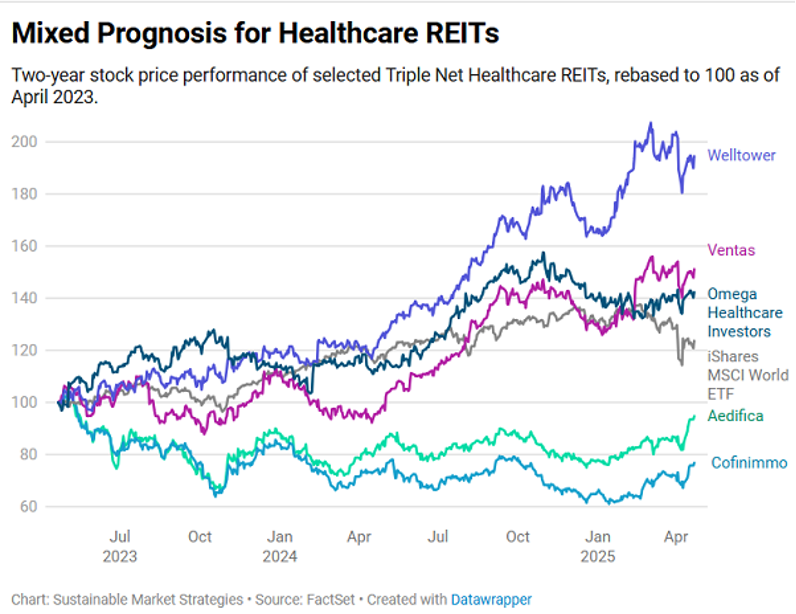

Regardless of the lease structure, acquisition strategies play a key role in driving growth for these REITs. Buying properties enables portfolio expansion and diversification across geographic regions and care models. In North America, Welltower (NYSE:WELL), Ventas (NYSE:VTR) and Omega (NYSE:OHI) are among the most active acquirers in healthcare REITs over the past five years. Each has acquired more properties than their peers’ average and, for Welltower and Ventas, at higher total transaction values. Incidentally, the stock price performance of these three names has also been above average over the past few years.

Final thoughts?

For investors worried about a tariff-induced recession, long-term healthcare facilities provide an interesting opportunity to wait out the storm. Healthcare REITs are poised to benefit from structural, long-term demand growth driven by aging populations in developed markets, and they offer defensive characteristics and reliable income amid economic uncertainty.

Lenka Martinek is an investment strategist with over 20 years of professional experience in research and capital markets. Previously, she worked for 15 years as a strategist for BCA Research, a leading provider of independent global macro investment research, and as a global macro portfolio manager in the CIO office at PSP Investments. Lenka joined Sustainable Market Strategies and Nordis Capital with the conviction that capital markets will play an integral role in transitioning to a more sustainable world. She heads the research efforts of both firms and is a member of the investment committee for Nordis Capital. Click here to learn more about Sustainable Market Strategies.

Securities Disclosure: Lenka Martinek does not personally hold any position in any securities that may have been mentioned in this article. Sustainable Market Strategies does not hold any securities that may have been mentioned in this article in its ESG Funds.

Disclaimer: This article should not be considered as investment advice or a recommendation to purchase any particular security, strategy or investment product. References to specific securities and issues are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

Please visit here to see information about our standards of journalistic excellence.