The devastating wildfires in Los Angeles are just the most recent reminders that the enjoyment of physical property should not be taken for granted. Insurance seems like a useless expense until you really need it. We sat down with Lenka Martinek, managing partner at Sustainable Market Strategies, who explains why owning the “insurance of the insurers” may be a smart portfolio addition for a future that will undeniably involve more frequent weather disasters.

Q: What is the “insurance of the insurers,” exactly?

Let’s make sure we have a common understanding of the insurance business as it relates to physical climate risks.

Property insurers are the first line of defence that provide coverage for property damage. To make sure they have enough money when large-scale events occur, their actuaries conservatively calculate the required funds necessary in case of an event and regulators put rules in place for them to hold sufficient capital to support the policies they have issued.

In order to lower their risk, and thereby reduce their capital requirements, property insurers will pay a fee to reinsurance companies to take on a portion of the financial risk of policies (generally the worst part). This allows property insurers to issue more policies with the same capital and grow their business from their direct contact with clients.

In this way, we call the reinsurers the “insurance of the insurers” because they are taking on the financial impacts of the worst possible event outcomes.

Q: So does that make reinsurers an extremely risky investment?

Not exactly. Reinsurers also need to be well-capitalized to satisfy regulators and reinsurers work hard to bring down their risk profile. They do this by having a diversified set of insurance clients and, like all insurers, they need to transfer risk to grow. They use tools like retrocession and issuing catastrophe bonds to further spread their downside risk.

Reinsurers are an extremely important part of the insurance industry. Their ability to take on the riskiest parts of property insurance is what allows client-facing insurance companies to ensure that insurance is available on the widest possible range of properties in changing climate conditions.

Q: Lots of insurance companies are no longer providing coverage in high-risk areas. Is this because reinsurers are also stepping back?

It’s true that insurers can no longer provide coverage at affordable prices in certain regions. Increasingly, we do see governments stepping in to complement or replace the private sector in some jurisdictions. But like most insurance coverage, government-backed schemes also use reinsurance as a risk mitigation tool. Again, access to property insurance in an increasingly difficult climate backdrop depends crucially on the willingness and capacity for reinsurance companies to take on the riskiest lines of a property insurer’s book.

Q: How do reinsurance companies make money?

Property reinsurance requires sophisticated modelling and risk management, but it is a relatively simple business from a profitability standpoint: premiums plus investment income minus claims and expenses determine profitability.

It’s important to note, however, that the reinsurance industry is quite cyclical and follows an “underwriting” cycle. After a phase of high profitability, strong past performance attracts more capital, and this new capital tries to gain new business with lower prices, putting pressure on prices across the industry. Most recently, renewal rates were at their weakest in 2018 after seven years of strong profitability. Then, from 2018 to 2021, poor profitability gave way to an improvement in pricing (higher premiums), which resulted in much better profitability—and stock price performance.

Climate change is putting pressure on insurers to reinsure a greater proportion of their risk.

Lenka Martinek

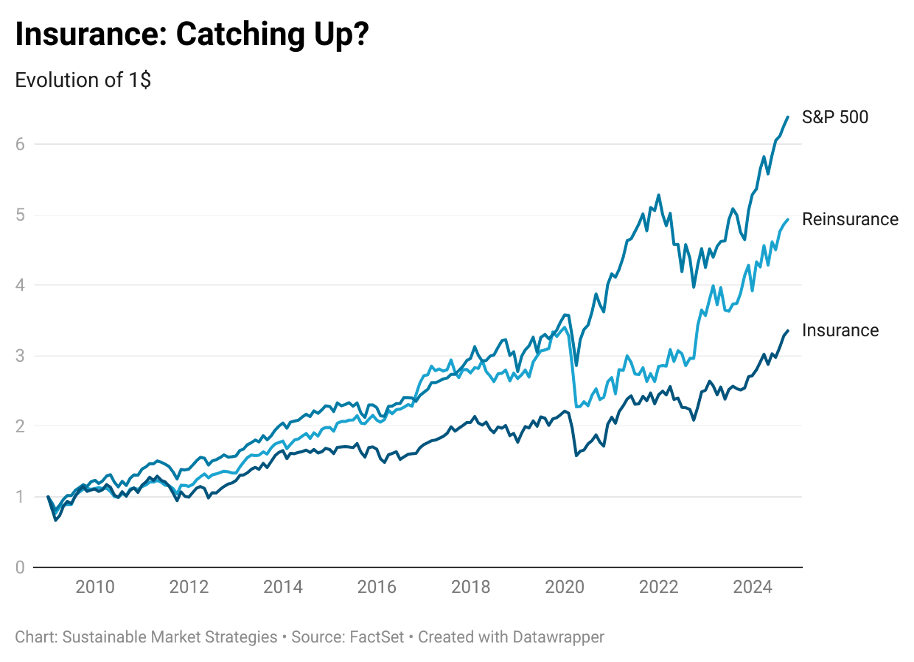

Comparing insurance, reinsurance and the S&P 500 Index, reinsurance has been one of the few subsectors that have nearly matched the strong performance of the S&P 500. We can also see a significant fall in price at the start of the pandemic for reinsurers because they also cover extreme mortality events on top of property insurance. The risk for reinsurers at the onset of the pandemic was excess mortality from COVID, which turned out to be less than originally feared. During the pandemic, reinsurers’ stock price fell much more than insurers when confronted with a potentially large event because they take on the extreme downside risk.

Q: Can you comment on how the insurance and reinsurance business is changing due to climate change?

The growing frequency and severity of climate-related events, such as floods, wildfires, hurricanes and other natural disasters, has forced insurers to re-evaluate their business models and adapt. Some of the techniques involved in doing this include:

- Enhancing risk models with advanced technologies and data analytics that take the impact of climate change into account.

- Adopting location-based pricing, where the price or coverage is tied to the geographic risk of climate change.

- Promoting climate-resilient practices with discounts for flood-resistant materials and storm-resistant infrastructure.

- Transferring a greater proportion of their climate-related risk to reinsurers.

Q: When is the right time to buy reinsurance stocks?

Reinsurers tend to be more profitable when they underwrite more business (i.e., they benefit from economies of scale). From this standpoint, the long-term outlook is very positive. Property values have increased a lot in the past decade, and the most expensive properties are often in high-risk areas. (L.A. is a strong case in point.) Climate change is putting pressure on insurers to reinsure a greater proportion of their risk. Thus, higher property values, a greater proportion of insurance that needs to be insured, and more catastrophic events from climate change all indicate that reinsurance volume has excellent long-term tailwinds.

That said, as explained above, annual profitability is dependent on the underwriting cycle. Reinsurance contracts are generally renewed on an annual basis, so December is the most important month. After very strong pricing power over the last two years, last December saw property reinsurance drop by about 10%. Generally, weak pricing power lasts for a couple of years. If the California wildfires are an indication of a really high loss year, pricing power could come back at the end of this year.

The long-term trend for reinsurance looks strong, and we hope to see exciting entry points later in 2025 as events materialize.

Securities Disclosure: Lenka Martinek does not personally hold any position in any securities that may have been mentioned in this article. Sustainable Market Strategies does not hold any securities that may have been mentioned in this article in its ESG Funds.

Disclaimer: This article should not be considered as investment advice or a recommendation to purchase any particular security, strategy or investment product. References to specific securities and issues are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

Please visit here to see information about our standards of journalistic excellence.