February’s tariff reprieve is in the rear-view mirror, and nothing about the future of Canada’s most important trade relationship has become clearer since then.

On March 12, President Donald Trump implemented a fresh round of tariffs on imported steel and aluminum, including from Canada, that are higher and more extensive than the ones he introduced in his first term. Canada and the European Union responded with retaliatory tariffs. Earlier, Ontario Premier Doug Ford had retaliated with a surcharge on electricity exports to the U.S., prompting Trump to threaten to double the tariff on metal exports—and then both backed down.

All that in just one week.

Who knows what fresh protectionist measures may follow, or whether or for how long the existing Trump tariffs and retaliatory measures from Canada and other trading partners will go on. (The exemption from the 25 per cent tariff for imports covered by the Canada-U.S.-Mexico agreement expires on April 2, and Trump has promised a new round of what he calls reciprocal tariffs against what amounts to the whole world.)

Markets certainly don’t know. Throughout the past week, they’ve yo-yo’ed—falling dramatically, recovering some ground, falling, moderating, and falling again. On March 13, the benchmark S&P 500 officially entered correction territory, down 10 per cent from its month-ago peak.

The only certainty for advisors and investors, not to mention business leaders, is that the near-term future will be marked by more uncertainty.

Shifting goalposts

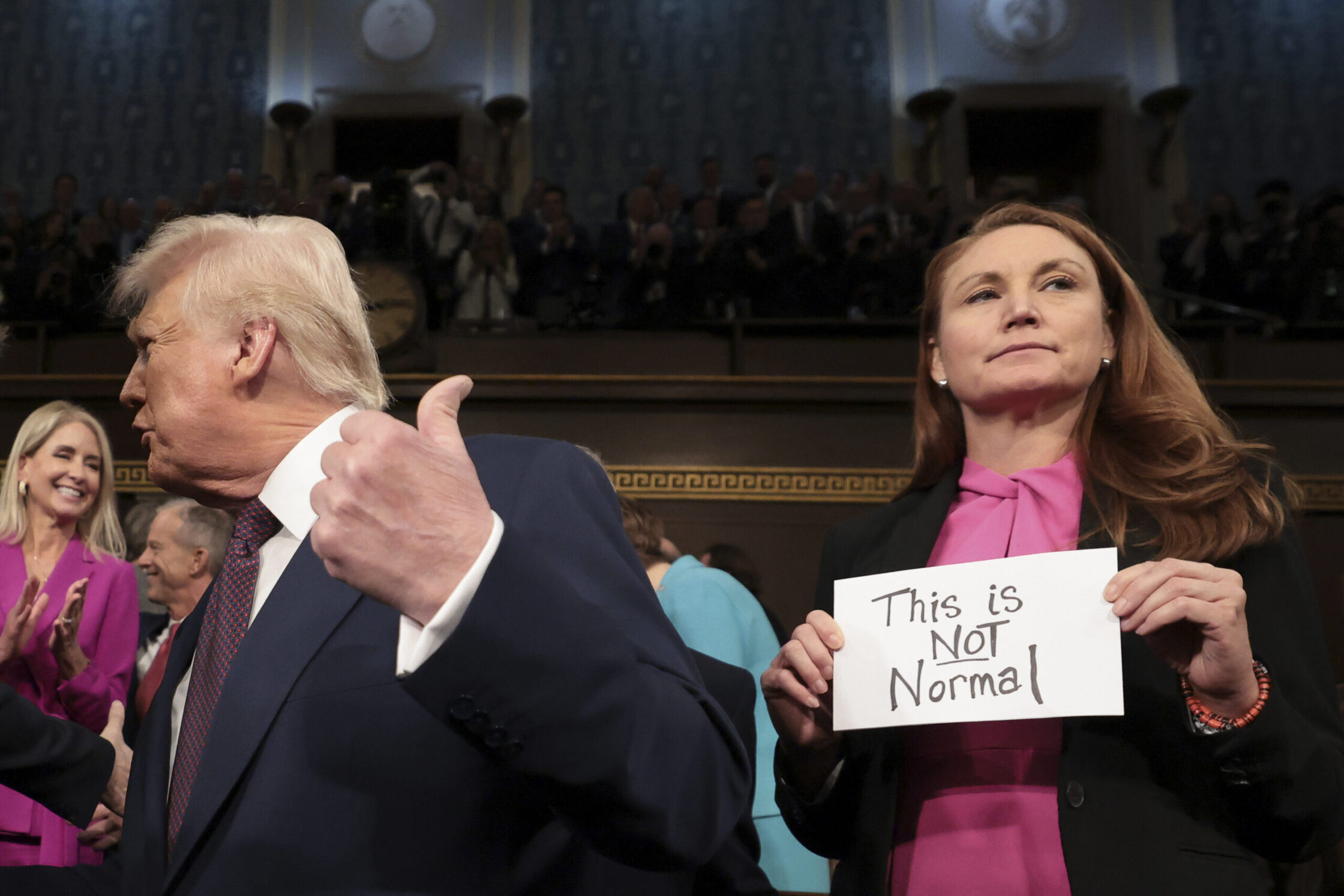

All the tough talk on tariffs from Trump coincides with other dramatic U.S. policy shifts, of course, including a reduction in the size and scope of the federal government, spending cuts, a hard line on illegal immigration and a reorientation of its support for Ukraine in that nation’s fight against Russian aggressors.

Another big shift is this: The Donald Trump of 2016 was laser-focused on the stock market as a proxy for economic well-being, but that no longer appears to be the case.

“I doubt the recent stock market dip will influence Trump,” says Vivek Astvansh, associate professor, Desautels Faculty of Management at McGill University, and a researcher on trade negotiations. “He has stated earlier that short-term pains will lead to longer-term gains for America.”

But what are those potential gains? It’s hard to decipher. Beyond the President’s explicitly stated goal of combatting illegal immigration and the fentanyl trade, or of reshoring manufacturing—a mission that may or may not be aided by tariffs, which are likely to raise input costs for U.S. companies—some observers argue that Trump is deliberately spooking markets to engineer a moderate market crash. That could trigger a manageable recession to force the U.S. Federal Reserve’s hand and provide the rate cuts some see as necessary to pay the interest on America’s staggering US$36-trillion national debt and improve bond markets.

Others, noting Trump’s particular animus towards Canada, wonder if the end game really does involve forcing economically battered Canucks to beg to become part of the U.S.—something Trump himself has repeatedly proposed, much to the consternation of his northern neighbours.

The reality, however, is that Trump’s motivation in starting a trade war with America’s closest ally is as unclear as the likely outcome. As Philip Petursson, chief investment strategist at IG Wealth Management, puts it: “Don’t ask me what the score is—I don’t even know what game they’re playing.”

Navigating volatility

Petursson notes that the only thing markets have been successfully predicting is that everything is going to change, adding that they have been pricing in a tariff regime that will last anywhere from three days to six months.

Given that uncertainty, what can investors and their advisors do to weather the storm?

“We classify this as more of a disruptive event as opposed to a destructive event, meaning this will come to an end at some point and we will get back into a normalized environment,” Petursson says. “We often say to our clients, ‘Don’t let your emotions guide your portfolio decisions because you’ll be prone to mistakes.’ However, that doesn’t mean do nothing.”

In a volatile environment, he says that portfolio diversification remains the best protection. On the other hand, major portfolio readjustments at this point could leave investors stranded when markets rebound.

“You can take comfort in the fact that there are other positions within diversified portfolios that are doing well,” Petursson adds. “International equities are doing well, bonds continue to be a backstop for portfolios, and gold has actually provided some defence in this environment.”

He believes the Canadian economy will face challenges, because tariffs could affect the fortunes of businesses dependent on the U.S. The TSX, however, should be more resilient. He notes that most of the exporters in Canada are subsidiaries of U.S. or European businesses—not necessarily Canadian companies listed on the TSX.

“The 10 per cent tariff on Canadian oil exports is also being offset by the weaker Canadian dollar,” he says. “Certainly, it’s not going to change the flow of oil from Canada into the U.S., and the U.S. consumer will bear the cost of it. The financial sector shouldn’t be as impacted by the tariffs. So, it’s a small proportion of Canadian-listed companies that would feel direct impact.”

Petursson says, in fact, that the S&P 500 is more sensitive to foreign tariffs than the TSX, because so many U.S. companies—major retail, apparel and technology companies, for example—rely heavily on foreign suppliers.

“When you combine that with valuation on the U.S. stock market, versus the Canadian market or international markets, it looks like the rest of the world should actually weather through the tariffs, perhaps better than U.S. equity markets will,” he adds.

The relative immunity of the TSX to the current tariff regime is also apparent to Angelo Kourkafas, senior investment strategist with Edward Jones. He notes that large exporters, such as the auto sector, account for an undersized 0.5 per cent of the TSX, while financials, which make up about a third of the index, are largely unaffected. His advice to investors is to pay attention to markets, not to chase headlines.

“There’s a lot of what I would call known unknowns, but when we look at how markets have actually responded, we find that the price action at the TSX is not as dire or alarming as the headlines suggest,” he says. “Yes, we have seen some more volatility, especially looking at the Canadian dollar, which has been very sensitive to trade headlines.”

Kourkafas notes that the strength of the Canadian economy continues to offer a buffer—the result, in part, of recent Bank of Canada rate cuts. However, that momentum could be cut short by a protracted and escalating trade war.

He also preaches portfolio diversification, especially in light of currency fluctuations, as exposure to foreign markets may provide an offset for movements in exchange rates.

A blessing in disguise?

Over the longer run, Kourkafas believes that U.S. tariffs are likely an effort to level the playing field of international trade without hobbling the U.S. economy.

“We will likely still see tariffs down the road, but at a much lower levy than what’s initially been thrown out there,” he says. “Recent action indicates that there is room for negotiations, especially when U.S. business sectors get hurt and, more broadly, investor sentiment and consumer sentiment has been impacted not only in Canada but in the U.S., where it all started.”

More Bank of Canada rate cuts—it lowered its benchmark rate by 25 basis points, to 2.75 per cent, on March 12—could also change the economic outlook, depending on the toll that tariffs are taking on the economy and the state of the Canadian dollar.

“If tariff threats turn out to be more bark than bite and they are rolled back in days or weeks, CAD likely rallies and brings USD/CAD back to 1.38,” says Tom Nakamura, vice-president and portfolio manager, currency strategy and co-head of fixed income, AGF Investments. “If the tariffs are rolled back in short order and the impacts are limited, the Bank of Canada may not be easing policy rates and may adopt a more neutral stance to observe how the Canadian economy fares. Inflation expectations are likely to fall and would benefit longer-run bond yields.”

Over the long term, however, many believe that persistent global tariffs could realign global trading relationships, as trading partners bypass an increasingly fickle U.S.

“The blessing in disguise is that the global scope of tariffs may bring affected countries together,” Astvansh says. “These tariffs would trigger a longer-term misalignment between America and Canada/Mexico and, hopefully, a longer-term alignment between Canada/Mexico and European/Asian countries.”

Nakamura, Kourkafas and Petursson also agree that the short-term pain imposed by U.S. tariffs offers a silver lining: an opportunity for Canada to become more self-reliant, to reduce interprovincial trade barriers and to better position its economy for the future, while developing new and enhanced global trading relationships

“A renewed focus on improving innovation and productivity and on diversifying our trade relationships would be a positive step,” Nakamura says. “This opportunity to adapt exists not just for Canada, but also for other countries that value open, global trade.”

The Canadian Family Offices newsletter comes out on Sundays and Wednesdays. If you are interested in stories about Canadian enterprising families, family offices and the professionals who work with them, but like your content aggregated, you can sign up for our free newsletter here.

Please visit here to see information about our standards of journalistic excellence.