Stenner Wealth Partners+ is an in person/virtual Multi-Family Office/OCIO Outsourced Consulting Team of financial/wealth specialists with a boutique approach and global perspective servicing Canadian and US investors/households, family offices and foundations, with generally a minimum of 10M+ in investable assets or 25M+ net worth.

As a CG Wealth Management team, SWP+ is a highly exclusive practice team with one of Canada’s largest independent wealth management firms. Canaccord Genuity/CG Wealth has $133.6B CDN in Client Assets under management globally as of September 30th, 2025.

Client Range of Net Worths: Between $25M To $3B+. New Client Engagements: Strategically on-boards only 6-8 new key relationships annually. Licensed with FINRA in the United States and CIRO in Canada.

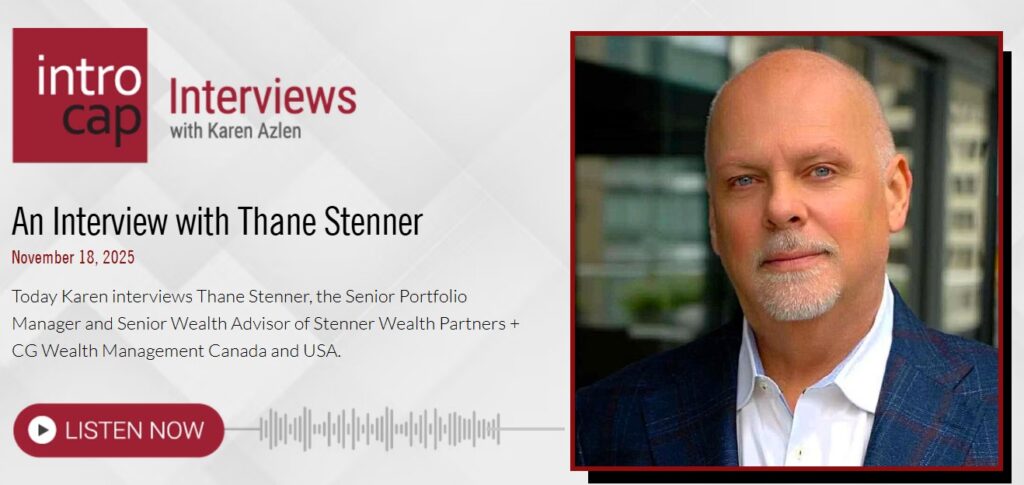

Mastering Wealth Management: Insights from Thane Stenner on Building Client Trust and Managing Portfolios

In this insightful episode, Karen interviews Thane Stenner, a veteran in the wealth management field with over 30 years of experience. Thane shares his journey from being inspired by his father, a wealth advisor for nearly five decades, to meeting industry icons and evolving his practice to cater to ultra-high net worth clients. He discusses his investment strategies, the importance of asset allocation, and the benefits of alternative investments. The episode also highlights the structure and culture of his boutique advisory team at Stenner Wealth Partners, their proactive and personalized client service approach, and the process of earning and maintaining client trust. Thane elaborates on managing cross-border clients, addressing major market changes, and the key to successful long-term client relationships. He also provides valuable advice for clients undergoing major liquidity events and shares his perspectives on the future of wealth management, emphasizing the growing role of technology and the enduring importance of personal relationships. Suitable for anyone interested in wealth management, this episode offers a wealth of knowledge and practical insights.