For years, the world of alternative investments was limited both in scope and accessibility. Niche strategies driven by merger-arbitrage and long-short equity dominated the space and were largely available only to ultra-high-net-worth individuals and institutions. That started to change in the late 2000s with the entry of retail offerings. Today, retail investors can access a growing range of alternative funds. These are typically long-term holdings, and selecting the right alternative investments for a portfolio is critical—and requires much more work than choosing highly liquid equities.

At Foster & Associates, alternative investments represent a key and comprehensive focus area of its Family Office Group. Philip Marion, the firm’s Managing Director and Portfolio Manager, has worked in the space for nearly two decades and has seen and navigated the early wave of popularity in the 2010s, the growing pains of not being structured properly for illiquid assets that stalled momentum, and the evolution that continues to fuel growing interest.

Philip sat down with Canadian Family Offices for a conversation about that evolution, the role alternatives can play in a portfolio—especially when market volatility is high—and what investors need to know.

Why are alternatives an answer to portfolio flux?

Alternative investments are not subject to the short-term swings of the public markets. They are more correlated with the general economy. We know that in any year, something can happen that gives the markets and investors a reason to panic—this year, it’s the U.S. trade war with the world. Investors are on edge. With all of the options now available—real estate equity, real estate debt, the many forms of private equity—alternative investments are increasingly replacing bonds within a portfolio to bring balance and manage risk.

Why are alternatives a focus area for Foster & Associates?

Our clients are focused on transitioning assets to the next generation. The investment time horizon for investing is much longer than planning for retirement. We can afford to go into alternative strategies that have long redemption cycles, which means great exposure to opportunities they otherwise wouldn’t have.

Why does it seem that just about everyone is investing in alternatives right now?

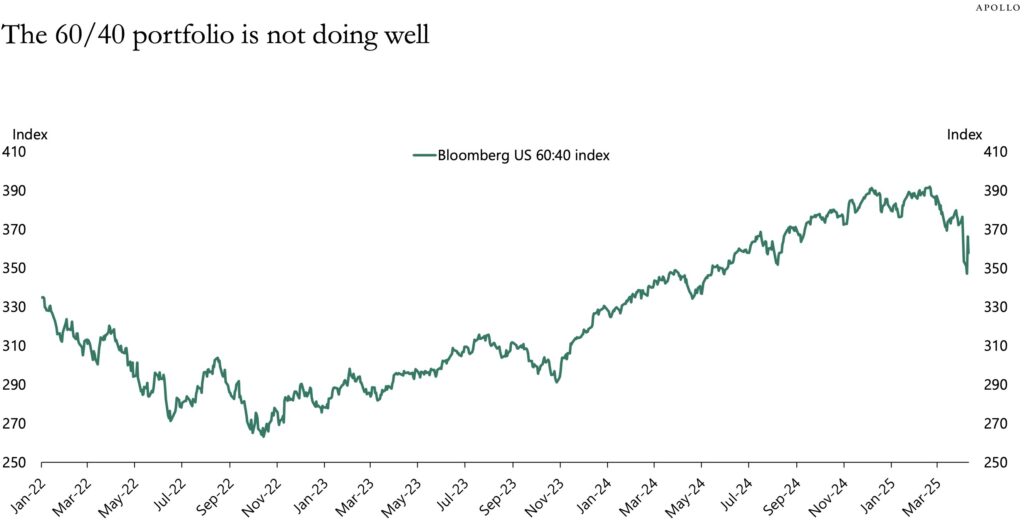

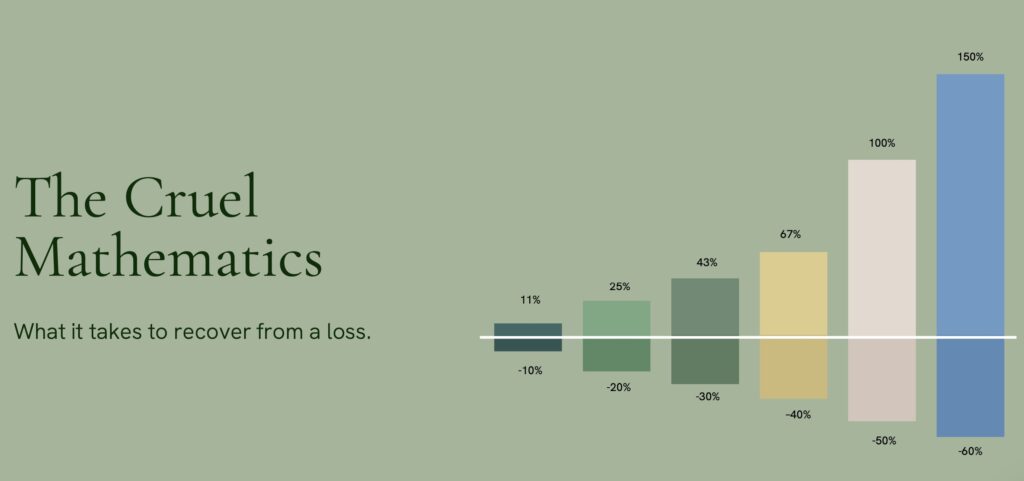

The classic 60 per cent stocks/40 per cent bonds diversification strategy is being challenged. For a long period of time, and for most investors, it was a great strategy because stock prices and bond prices tended to move in opposite directions. If the market was suffering from uncertainty and stock prices declined, you could rely on bonds to provide stability. Over the years, that assumption has started to fail. The year 2022 was a clear example. Both stocks and bonds dropped in value. As a result, the traditional 60/40 portfolio did not do well.

It’s happening again today. The market is down and so are bonds. It’s the same in good times. In 2023 and 2024, stocks and bonds were positively correlated. The balance that bonds previously provided to a portfolio isn’t being delivered. Alternatives, which have matured and now offer more effective investment structures and liquidity provisions, can fill that role. We are also seeing powerhouse U.S. alternative asset managers such as Blackstone, KKR and Apollo Global Asset Management enter the Canadian market, piquing investor interest.

What is Foster & Associates’ approach to managing alternative investments?

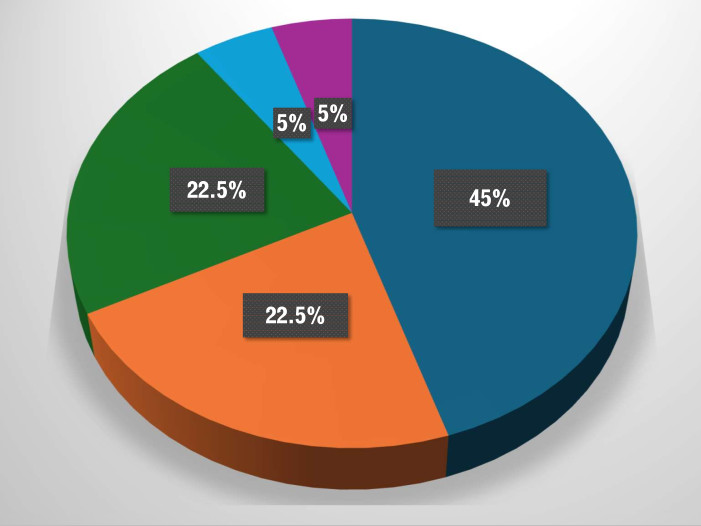

A few things set us apart: our extensive experience, our focus on diversification, and our comprehensive and ongoing due diligence. Now that alternatives have become more popular and many funds hold multiple offerings, we are seeing advisors who are new to the space dipping their toes in and concentrating on one or two issuers instead of fully exploring the options available. We look at diversification both strategically and operationally. This means we want to make sure we are diversified with respect to strategy type and issuers.

In our Family Office Group, we have broad exposure—from real estate to private equity to merger arbitrage to music royalties to private infrastructure. We also have specific rules. The maximum weight for any one strategy within our alternatives model is 15 per cent, and we can’t have more than two mandates for any one issuer. That keeps us aligned with our risk management and ensures we don’t get too exposed to one particular firm or strategy.

For us, due diligence does not stop with the initial allocation—it’s ongoing. We have our own due diligence questionnaires tailored for each strategy. It’s required we meet with management multiple times. We must go to their office, see where their employees are. We review their financials in detail. In our initial assessment, we’ll do a lot of investigation into managers, including talking to people we know on the street. Once all the boxes have been checked, we’ll look at where the strategy will fit and its weighting in the portfolio, and our dedicated alternatives committee will review the company’s fundamentals and financials each time they are issued.

We have to continuously prove this investment is suitable for the portfolio and the firm. This includes regular meeting with managers to make sure we don’t miss any red flags. For example, when a manager issues a sudden update on a change in strategy, we conduct due diligence all over again to decide if we are willing to accept the change or if we have to exit.

Another of our rules is that for any of the alternatives that pay distributions, we take the cash whenever possible.

Right now is a perfect example of why that’s important. Our alternatives weight is growing because stock market valuations have been shrinking. By taking the money, we reduce risk and end up rebalancing into parts of the market that have been underperforming.

How do you assess alternatives managers?

A lot of firms rely on quantitative measures, such as average drawdown or the amount of alpha in a strategy. That information is important, but we think governance is much more important, which is why we focus on valuation policies. For example, if we are evaluating a big fund group that moves assets between entities, we want to know: What is your valuation committee? How often do you get individual assets appraised? If you are publishing net asset value (NAV), how often do you update all the prices of each of the private assets that make up that NAV? A lot of firms are sloppy in this area. If investors lose confidence in the NAV, redemptions will flood in.

What should investors know about navigating the evolving alternatives space?

There is no place for complacency. It’s critical to actively manage liquidity and risk and to diversify. This requires constant review and a willingness to change managers if necessary—easier said than done in the alternatives space. While stocks and bonds are transactional, investing in alternatives is based on the relationships built with individual managers. It’s difficult to leave people you like and trust, but it’s important to have parameters in place that will help you make the hard decisions.

Disclaimer: This story was created by Canadian Family Offices’ commercial content division on behalf of Foster & Associates.