Implementing effective investment tax management strategies can lead to significant savings and improved net returns.

Thane Stenner, founder of Stenner Wealth Partners+ at CG Wealth Management and of ultra-high-net worth investor peer network Tiger 21 in Canada, knows this all too well. His highly distinguished career spans 25-plus years and includes previous senior roles such as Managing Director and Institutional Consultant at Morgan Stanley and Graystone Consulting, their elite global institutional consulting division. He hosts the Smart WealthTM with Thane Stenner podcast, produced by the BNN Bloomberg Brand Studio. Thane’s virtual/in-person Multi-Family Office/Outsourced CIO Consulting team deals with 51 clients across Canada including many Single-Family Offices (SFOs) (previously #1 Ranked California based consulting team on the Barron’s Top Institutional Consultants 2020 List, and now based back in Canada for the last four years). Thane and his US and Canadian teams have guided/transacted on billions of dollars worth of securities over his career.

Stenner sat down with Canadian Family Offices to share how SFOs and uber wealth investors can boost investment returns by applying tried-and-true tax-efficient strategies to investment portfolios.

Why is it important for ultra-high-net-worth families and their family offices to adopt a ‘tax alphaTM’ approach to managing their investment portfolios?

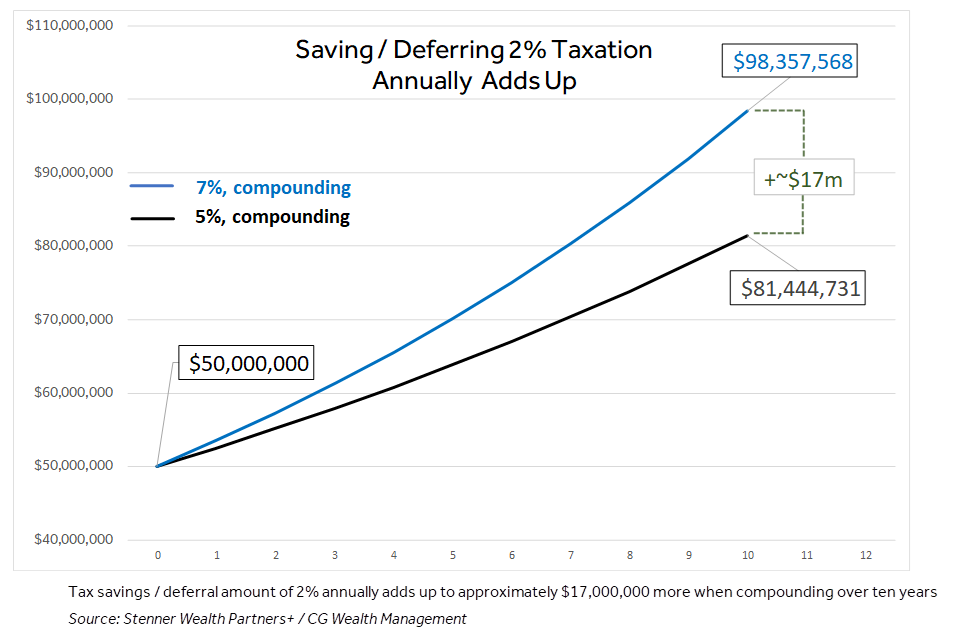

Over and above fees, the number one annual cost for SFOs is tax. Even though it’s the biggest expense, many SFOs are not focused enough on tax minimization strategies. This is a missed opportunity. Tax optimization can save or defer anywhere from one per cent to three per cent per year on your portfolio over time. Put another way, reducing the amount of “tax drag” adds extra return to the overall portfolio over time. The impact is significant.

How can SFOs/wealthy families adopt a tax alpha approach to investing?

There are several CRA-recognized tax alphaTM/minimization/reduction tools and tactics worth exploring for SFOs, with the caveat that the tax tail should not wag the investment dog. Rather, while the priority is to select the right investments that will help you achieve your investment goals, a strong secondary lens is to consider the tax implications of these investments and whether there is a more efficient opportunity to achieve goals and minimize tax.

When it comes to optimizing tax, there are two overarching strategies:

- Invest in assets that generate tax-preferred income, such as dividends, capital gains and return of capital (RoC). This will allow you to pay less tax on cash flows, unlike interest income from fixed-yield investments such as bonds and guaranteed investment certificates (GICs), which is 100 per cent taxable at typically highest marginal tax rates.

- Try to defer taxes as long as possible. Deferring tax to the back end of an investment means that you have more cash in your pocket today to earn income.

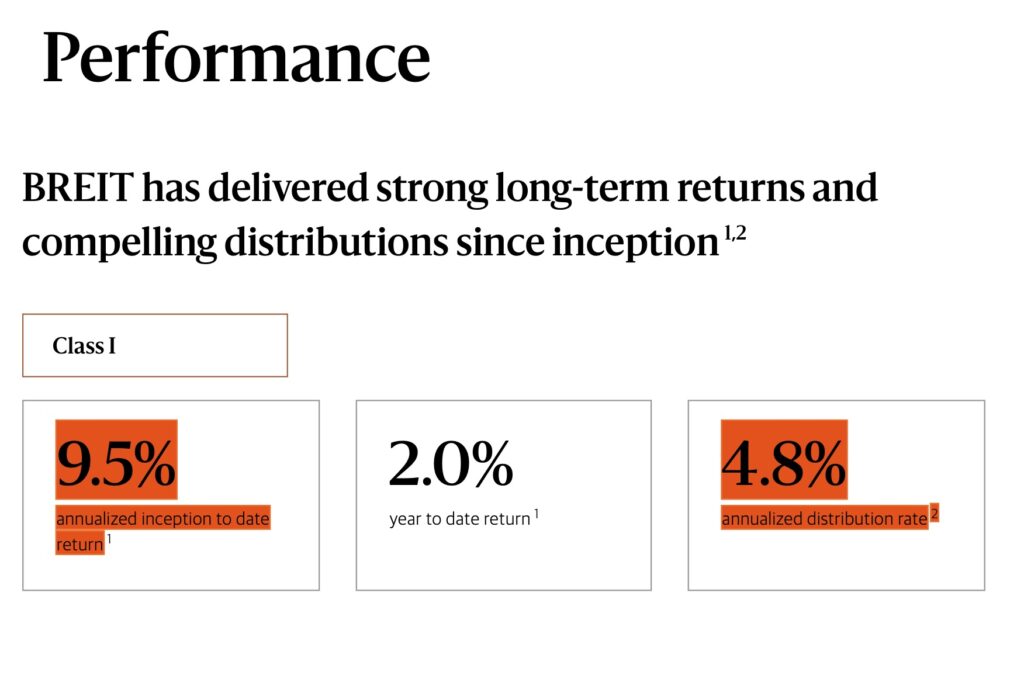

For example, in addition to providing cash flow and appreciation, real estate investment trusts (REITs) represent an opportunity for investors to receive tax-deferral returns in the year of distribution and the ability to defer taxes longer term.

The Blackstone REIT is a global real estate income trust that has an annualized distribution yield of between four per cent and five per cent that is taxed as return on capital. A GIC or bond would have to generate 7.5 per cent to realize the same return.

What are some of the top tax alphaTM strategies you use to help your clients?

We are not CPAs or tax specialists, but we work very collaboratively with our clients’ tax advisors. Given that most of our clients have net worths above $25M, and north of 1B+ in some cases, it is very important to explore tax alphaTM strategies with our clientele and their key tax advisors and advanced insurance specialists. With that context, there are several effective tax alphaTM strategies available to ultra-high-net-worth families, including:

- Investing in flow-through limited partnerships in the mining and critical minerals sectors

“This is a win both for junior resource companies in Canada and investors,” says Neil Colquhoun, CPA, CA, co-founder of multi-family office HNW Services Inc. “The federal government supports it because it allows these companies to gain capital to explore for minerals. Purchasing flow-through shares gives the buyer an immediate full deduction for the price they paid, as well as additional tax credits. It’s a way to have a preferential deduction for investing in these industries with limited risk. In the past, you’d buy flow-through shares, get the deduction and hope that the junior resource company would be successful. Today, there are some programs that effectively guarantee a buyer for these shares the following year.”

- Implementing deferral/diversification strategies using the Income Tax Act’s Section 85 rollovers

This offers a way for taxpayers to transfer business assets to a corporation at cost and without incurring income tax on the transfer. It can be employed in a number of use cases. For example, founders with a concentrated stock position tied to their public company can use the Section 85 rollover to shift into a diversified portfolio with cash flow, de-risking and diversifying their position.

- Focusing on preferential tax treatment

For example, while you will be fully taxed on the interest income you receive from a corporate bond, if you purchase an interest-paying bond at a discount, the discounted price to maturity will be treated as a capital gain when the bond matures at par.

- Being tax-efficient with philanthropic/charitable donations

Many ultra-high net worth families tend to be philanthropic. One of the most tax-efficient ways to support causes you care about is by donating publicly listed securities in kind with accrued capital gains. The charity benefits from the donation, while you benefit from the elimination of the capital gain tax and the donation tax credit. This can easily be done through a personalized Donor Advised Fund (DAF).

The art of taxation consists in so plucking the goose as to obtain the largest possible amount of feathers with the smallest possible amount of hissing.

Jean-Baptiste Colbert, a French statesman, who became the Controller General of Finances, 1665

- Leveraging spousal loans

“Now that interest rates are coming down again, there is growing interest in spousal loans as a way to shift income from one spouse with a great deal of wealth to another who is not in the top marginal income tax bracket,” says Colquhoun. “The loan received by the spouse has a locked-in interest rate for the life of that loan. The loan’s interest rate is the Prescribed Rate, as set by the Canada Revenue Agency, in effect at the time the loan is made. All income that the spouse earns over and above the interest paid on the loan, is taxed in the spouse’s hands, so the lower the prescribed rate, the more the likelihood of this planning being successful. In fact, in recent years, the prescribed rate has been as low as 1%. Today the rate is 4 per cent.”

- Optimizing tax deductions of SFO expenses and investment/outsourced chief investment officer fees

Make sure your SFO expenses and wealth management fees are being optimized and applied against the right sources/entities (i.e., the companies, trusts, or individuals generating the income).

- “Tax harvesting” (Optimization) throughout the year

In any globally diversified portfolio, especially for very wealthy investors, there will be stars as well as laggards. Tax harvesting, also known as tax loss optimization, is a way to offset realized taxable capital gains by identifying and triggering unrealized capital losses throughout/strategically. We typically work with our clients and key tax advisors to do this throughout the year to minimize year-end tax costs. It is important to be strategic in selecting the investments you want to sell. For example, you target an investment you no longer have confidence in and that you don’t believe will rebound within the next 30 days. That’s because if it does start to climb within 30 days of selling, you won’t be able to buy it back without triggering the CRA’s superficial loss rule.

Why is it important for ultra-high-net-worth families to have their wealth advisors work with key tax advisors to explore tax alphaTM strategies?

Collaboration in this space is incredibly important. I’m shocked at times how little collaboration there is. We try to work hard in this area because at the end of the day, the client benefits. We provide our clients’ tax specialists with year-to-date, realized and unrealized reports on a monthly or quarterly basis. This allows us to anticipate challenges and opportunities together. The above tax reduction strategies are just some of the various tax minimization ideas that our key clients and their tax advisors avail themselves with.

*Responses have been lightly edited for clarity and length.

Follow Thane Stenner and Stenner Wealth Partners+ on LinkedIn.

About Stenner Wealth Partners+

Stenner Wealth Partners+ (SWP+) is an in person/virtual Multi-Family Office/Outsourced CIO Consulting team of financial/wealth specialists with a boutique approach and global perspective. SWP+ serves Canadian and US investors/households with generally a minimum of 10M+ in investable assets or 25M+ net worth. As a CG Wealth Management team, SWP+ is a highly exclusive practice team with one of Canada’s largest independent wealth management firms. Client Range of Net Worths: between $25M To $2.5B+. New Client Engagements: Strategically on-boards only 6-8 new key relationships annually.

About CG Wealth Management

The global wealth management business is entrusted with C$115 billion in client assets.1 The wealth management operations of the Canaccord Genuity Group (CG Wealth Management) provide comprehensive wealth management solutions and brokerage services to individual investors, private clients, family offices, Donor Advised Funds (DAFs), and intermediaries through a full suite of services tailored to the needs of each client.

1Canaccord Genuity Annual Report, December 31, 2024

Disclaimer:

This story was created by Canadian Family Offices’ commercial content division on behalf of Stenner Wealth Partners+ at CG Wealth Management, which is a member and content provider of this publication. CG Wealth Management is a division of Canaccord Genuity Corp., member Canadian Investor Protection Fund and The Canadian Investment Regulatory Organization. Thane Stenner’s views, including any recommendations, expressed in this article are his own only, and are not necessarily those of Canaccord Genuity Corp.