In an economy where extreme volatility seems now to be normal, investors need the right tools to analyze the turbulence they should expect over the longer term. Foster & Associates has developed its own risk matrix—a tool its experts deploy to sit down with high-net-worth families and clients and help them manage today’s complex challenges.

Foster’s risk matrix is designed to be wide-ranging, yet also flexible, says Victor Todorovski, portfolio manager and financial planner for Foster Family Offices, one of the services the 31-year-old firm provides.

“The matrix is structured in a way that lets us sit down with clients and help define the potential risks to their portfolios and other holdings, such as real estate investments,” he says.

“It’s not a math formula—we’re not trying to solve physics problems. We look at various possible risks, how likely each one is to happen and, if it does happen, how likely the risk is to impact our clients’ and families’ portfolios and what the impact might be.”

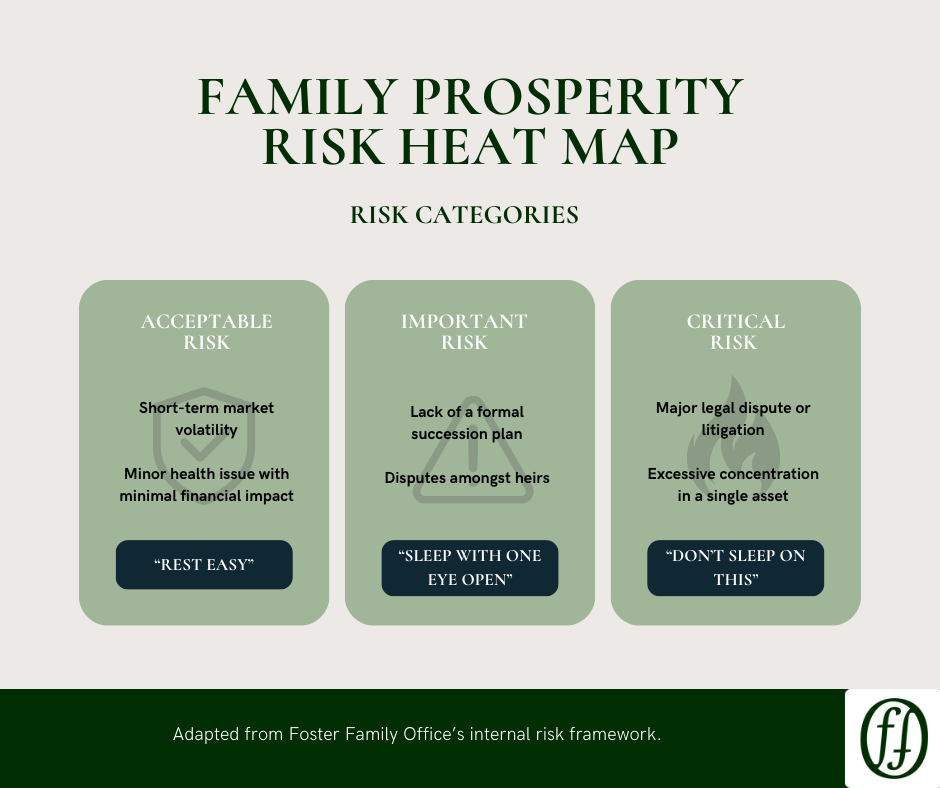

The matrix is portrayed as a “heat map,” colour-coded in similar way to the fire-risk signs Canadians see on highways. The vertical side of the matrix plots the probability of something happening that might affect a portfolio or particular investment; the horizontal shows the potential severity.

Events that come up in green on the matrix are classified as acceptable risks, while those in yellow are considered “important”. Those that come up in the red section of the matrix are classified as “critical.”

“Using the matrix helps us facilitate discussion with clients on what kinds of risk they would be comfortable taking. From there, we can develop strategies to manage particular risks. Another benefit to using a tool like the matrix is that it helps us to understand our clients better,” says Todorovski, who also teaches a course in Risk Management and Estate Planning at Toronto’s Centennial College.

What types of risk that Foster’s Risk Matrix consider? These days, they are so varied that they bring to mind the answer given decades ago to a young man by then-British Prime Minister Harold Macmillan about what was most risky about his job: “Events, my dear boy, events.”

Foster’s matrix not only looks at significant fluctuations in the economy but also considers why they might be occurring—for example, because of the on-again, off-again threats of tariffs by U.S. President Donald Trump.

Depicting such threats on a matrix helps take the decision-making process away from the daily news, which can trigger anxious and sometimes impulsive decisions. The matrix helps clients make calmer, more dispassionate long-term decisions, Todorovski explains. “It can clarify why it’s important in some situations to diversify into international markets, for example.”

The matrix also helps clients understand shifts in tax laws or increased regulatory scrutiny that may be in the offing. Such shifts can affect wealth preservations strategies, especially for families whose businesses are concentrated in one industry. Using the matrix can help individuals and families reassess their estate plans, Todorovski says.

The matrix can also help navigate family dynamics and the need to pay better attention to succession planning.

“Mismanagement of wealth can erode family fortunes. The risk matrix can help families identify—and fix—common pitfalls such as unclear trust terms, inappropriate trustees and inadequate preparation of heirs to handle the wealth they will eventually inherit,” Todorovski says.

Family offices also face potential operational risks that Foster’s matrix can help pinpoint, so such risks can be rectified.

“There can be challenges such as fraud, unforeseen regulatory issues or scams and online risks such as phishing or identity theft. Sometimes these problems come from too little oversight of a family fortune, especially where there is one key person responsible for making financial decisions and moving money,” Todorovski says. The risk matrix can help families understand both the nature and severity of these kinds of problems.

Another potential risk that is sometimes overlooked, but which a risk matrix can address, is the health or lifestyle risks that can affect affluent investors or key decision-makers. Health problems such as obesity, heart disease and diabetes aren’t necessarily considered financial risks, but they become clearer when they appear on a matrix, Todorovski says.

Using a tool like Foster’s Risk Matrix can be particularly helpful in addressing the threat to investments posed by climate change and severe weather patterns, Todorovski adds.

“Families can be vulnerable if they own properties in those disaster-prone areas that are increasingly vulnerable to climate-related events. Storms, hurricanes, floods, fires or severe heat can lead to soaring insurance costs and potential asset devaluation,” he says.

Particularly in some high-risk U.S. states, property owners have seen premiums rise by 82 per cent, with some insurers withdrawing coverage altogether while the property values are declining.

“We had one family where the risk matrix helped them decide to sell a Florida property in time before it was destroyed by the category 4 hurricane Helene that hit Florida in 2024,” Todorovski says.

Working with a tool like Foster’s Risk Matrix is part of the process of getting to know your client, he adds.

“It’s a system that brings up things that they may not have thought of before. It’s a dynamic process that adjusts to the times—environmental considerations have become more important, for example,” he says.

“People may be surprised by the matrix at first, but usually they’re pleasantly surprised,” he says.

Disclaimer: This story was created by Canadian Family Offices’ commercial content division on behalf of Foster & Associates.