Thane Stenner explains why it’s time to take some profits from today’s overvalued U.S. markets, rebalance and reallocate assets to protect your portfolio gains and to drive further growth.

Thane Stenner, founder of Stenner Wealth Partners+ at CG Wealth Management and ultra-high-net worth investor peer network Tiger 21 in Canada, knows this all too well. His highly distinguished career spans 25+ years and includes previous senior roles such as Managing Director and Institutional Consultant at Morgan Stanley and Graystone Consulting, their elite global institutional consulting division. He hosts the Smart WealthTM with Thane Stenner podcast, produced by the BNN Bloomberg Brand Studio. Thane’s virtual/in-person Multi-Family Office/Outsourced Consulting Team deals with 51 clients across Canada including many Single Family Offices (SFOs) (previously #1 Ranked California based consulting team on the Barron’s Top Institutional Consultants List, and now based back in Canada for the last four years). Thane and his US and Canadian teams have guided/transacted on billions of dollars worth of securities over his career.

Stenner sat down with Canadian Family Offices (Feb. 19th/2025) to share why ultra-high-net worth families need to revisit their investment policy statement and asset allocation–today.

What is the big picture when it comes to the state of U.S. equity markets today?

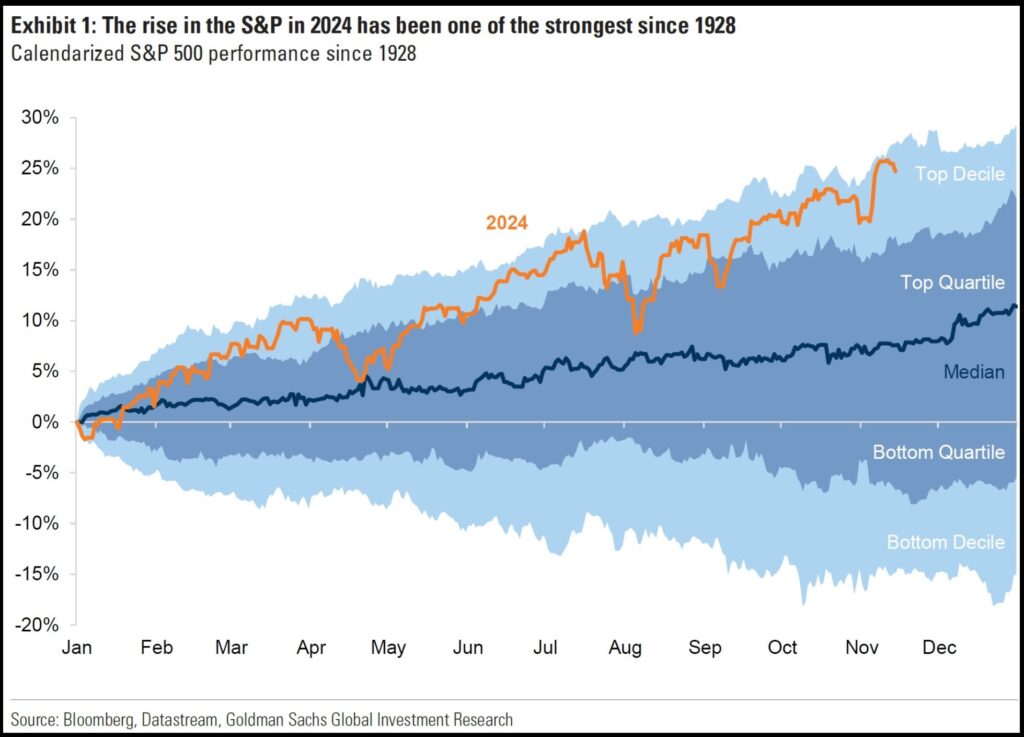

U.S. equity markets have generated annualized returns of between 14 and 16 per cent over the last 10 to 15 years. Amazing. The last two years were even better. Record-breaking performance has led to record-high valuations and sentiment, confidence and participation on the part of retail investors in the U.S. Global investors are equally caught up in what is being called American Exceptionalism–the belief that the U.S. is exemplary compared to other nations, so its economy and stock market will continue to outperform. History paints a different picture.

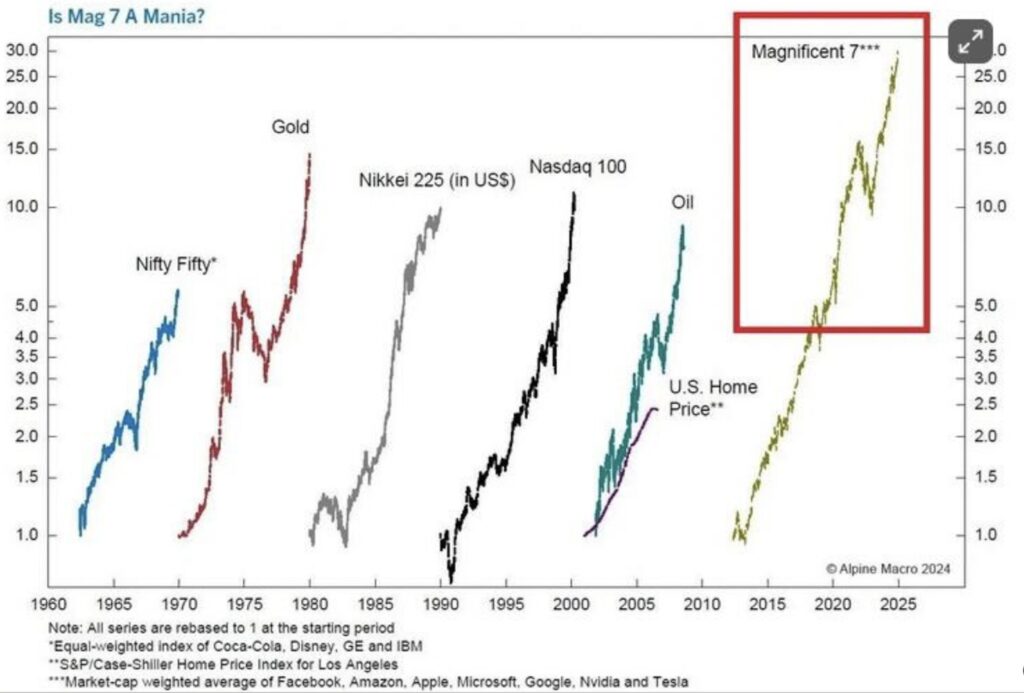

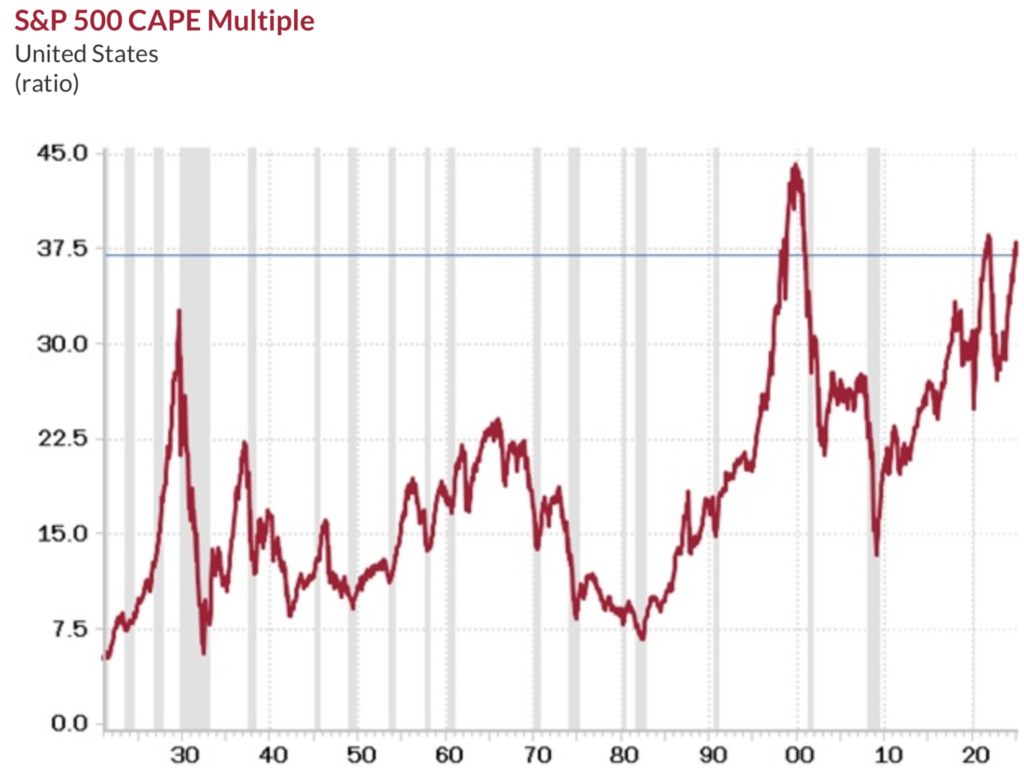

The numbers are compelling. The benchmark S&P 500 index enjoyed consecutive years of 20 per cent-plus growth in 2023 and 2024–the best performance since 1997 and 1998–thanks largely to the tech sector. The top 10 stocks on the S&P 500 account for one-third of its value–and they are all tech stocks led by the Magnificent 7 (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla) with Broadcom recently joining the mix. At the time of writing, U.S. equity markets are in the top three per cent of valuation metrics of all time, with U.S. stocks making up more than 70 per cent of global stock market capitalization.

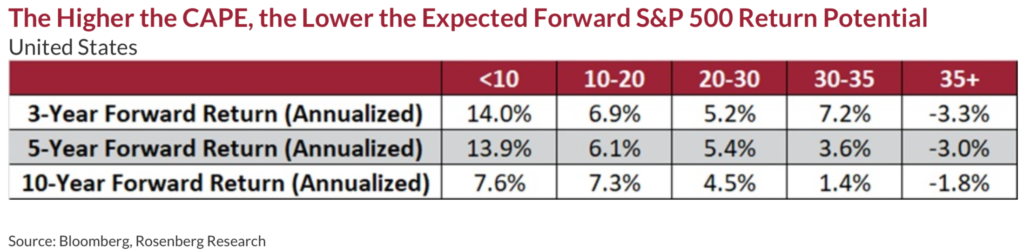

The last equity market with this level of concentration was Japan’s in 1989 before it collapsed. The Nikkei lost more than 80 per cent of its value over the next 18 years before starting its recovery. It’s not surprising, then, that top global hedge fund manager David Tepper, founder of Appaloosa Management, recently said there is no margin of safety or error with where U.S. equity market valuations are. He’s not alone in his concern. Other market thought leaders, including David Rosenberg, founder of independent research firm Rosenberg Research & Associates Inc1., Howard Marks, co-founder of global investment firm Oaktree Capital Management, and Jesse Felder, publisher of the Felder Report, all anticipate a decline in go-forward U.S. broad equity market returns for the next 10 years.

1Rosenberg Research, February 2025

How important is asset mix/allocation to portfolio performance over time?

Research studies tracking investment returns over 10-year periods show that asset mix/allocation–not individual stock selection—drives 85 to 92 per cent of mid- to long-term investment performance. For investors, it’s critical to turn your focus to what history and the evidence tells us. While nobody can time exact market peaks and lows, there are enough markers that strongly suggest this is the time for profit-taking and reassessing asset mix.

I believe it is highly possible to improve your long-term results by adjusting your investment position at the extremes of the cycle. Not that often. But at the extremes.

Howard Marks, Oaktree/Brookfield

What do you anticipate will happen this year with the U.S. equity markets?

In my opinion, we are in the very late stages of this U.S. bull market. Volatility will likely spike and I expect a significant corrective phase in the 15 to 30 per cent range at some point in 2025. Of course, there will always be pockets of value and buying opportunities in the U.S. equity markets, but they will be much harder to find. I think investors should also be looking at the Rest of the World (RoW) and other sectors beyond tech. For example, in the first six weeks of 2025, European markets outperformed U.S. markets. Year-to-date in mid-February, the S&P 500 was up three per cent in Canadian dollar terms, while some European markets were up anywhere from seven per cent to 10 per cent. This may seem counterintuitive given the threat of U.S. tariffs hanging over world economies, but the markets seem to view them as a sort of shock-and-awe negotiating tactic.

What should family offices do to minimize risk and enhance performance in their portfolios?

Most single-family and multi-family offices have or should have a detailed Investment Policy Statement (IPS) to provide longer-term strategic and short-/mid-term tactical guidelines/parameters to manage risk and enhance returns over time. I strongly suggest family offices make reviewing their IPS and actual portfolio asset mix a current priority and act now. All of the indicators make the case for urgency. There’s also record insider selling taking place by U.S. corporate CEOs–not a good sign. Getting your go-forward asset mix right will likely make a big difference in your portfolio’s overall performance over the next three to five years. Looking at the tactical ranges set to achieve strategic goals should point to the need to start underweighting the U.S. equity markets. Over the last 24 months, the U.S. markets have gone up more than 50 per cent. “Now is the time to be proactive, take some profits, and get defensive”.

What go-forward asset mix do you suggest in 2025 and looking out to the next one to five years?

I recommend investors take half of their U.S. equity holdings off the table and move to where the puck is going. According to the latest data, most investors are almost fully invested, with only three to five per cent cash or cash equivalent positions right now. In my opinion, this is not high enough. I think Warren Buffett provides a good leading indicator of where we should be. He is close to 25 per cent cash, or more than US$325 billion. I recommend investors increase cash/cash equivalent positions to between 10 and 20 per cent. At the time of writing, 10-year Treasury Bond yields are approximately 4.5 per cent. Depending on risk profile, income and cash flow requirements, investing 10 to 30 per cent of your portfolio in longer-term bonds could be a good defensive allocation. Depending on the size of your capital base, I would also recommend moving between 20 and 50 per cent of your portfolio into various alternative strategies (i.e., any investment that is not stocks, bonds or cash) such as commodities (20 per cent), and RoW equities (10 to 30 per cent), including Japanese and Emerging Market’s equities. Valuations are much cheaper, with many on sale, compared to U.S. equities. I also strongly suggest implementing hedging techniques to help your overall portfolio navigate what I think will be a year of bigger surprises.

How did your “Core” SWP+ discretionary mandates perform in 2024 overall?

We have two core discretionary mandates that hold low-cost third-party passive investments, which our team directly and actively manages as outsourced CIOs. Our Global Absolute Return (GAR) ETF Mandate holds low-cost exchange traded funds in different sectors and countries, and our Alternative Income Strategies (AIS) Mandate has 40 holdings, including ETFs, institutionally priced mutual funds, closed-end funds, and private debt or credit funds, and an estimated 4,000 underlying securities within those holdings overall.

In 2024, our GAR ETF portfolio generated approximately 17 per cent, with approximately “only” 41 per cent of the S&P 500 volatility (Canadian hedged), and roughly “only” 33 per cent of the Nasdaq volatility (QQQ Canadian hedged). During the bear market selloff in 2022, this portfolio was down about one per cent, while most markets, including bonds, were down between eight and 33 per cent. There have been 16 negative months for the S&P 500 (CAD hedged) over the last three or so years. Our GAR portfolio beat the S&P 500 (CAD hedged) 16 out of 16 times. The objective of the fund is smoother growth over time.

Our AIS portfolio had a gross yield of 7.49 per cent in 2024–the taxable equivalent of 11 per cent. This mandate is approximately 60 per cent daily liquid and approximately 40 per cent liquid within a year and provides tax-preferred cash flow.

What is your best advice for ultra-high-net-worth families?

The probability of a third consecutive year of 20 per cent-plus returns for U.S. equity markets is low. Take profits from the areas that have done really well and invest in areas that are on sale. For example, gold outperformed the S&P 500 in 2024, but the underlying gold miners, the equities, didn’t. They are trailing well behind the commodity and are trading at thirty to forty-five per cent discount to intrinsic value. Typically, that means there is going to be some catch-up in mining stocks. This is an important opportunity to reassess your asset mix to both protect your portfolio and position it for long-term growth.

*Responses have been lightly edited for clarity and length.

Follow Thane Stenner and Stenner Wealth Partners+ on LinkedIn.

About Stenner Wealth Partners+ (SWP+)

Stenner Wealth Partners+ is an in person/virtual Multi-Family Office/Outsourced Consulting Team of financial/wealth specialists with a boutique approach and global perspective. SWP+ serves Canadian and US investors/households with generally a minimum of 10M+ in investable assets or 25M+ net worth. As a CG Wealth Management team, SWP+ is a highly exclusive practice team with one of Canada’s largest independent wealth management firms. Client Range Of Net Worths: Between $25M To $2.5B+. New Client Engagements: Strategically on-boards only 6-8 new key relationships annually.

About CG Wealth Management

The global wealth management business is entrusted with C$110.4 billion in client assets.1 The wealth management operations of the Canaccord Genuity Group (CG Wealth Management) provide comprehensive wealth management solutions and brokerage services to individual investors, private clients, family offices, Donor Advised Funds (DAFs), and intermediaries through a full suite of services tailored to the needs of each client.

2Canaccord Genuity Annual Report, September 30, 2024

Disclaimer:

This story was created by Canadian Family Offices’ commercial content division on behalf of Stenner Wealth Partners+ at CG Wealth Management, which is a member and content provider of this publication. CG Wealth Management is a division of Canaccord Genuity Corp., member Canadian Investor Protection Fund and The Canadian Investment Regulatory Organization. Thane Stenner’s views, including any recommendations, expressed in this article are his own only, and are not necessarily those of Canaccord Genuity Corp.