Research shows only 12 per cent of family businesses make it to the third generation—a number that drops to three per cent in the fourth generation. Among the biggest challenges is a lack of communication and transparency, which can lead to conflict within families, says Arnaud de Coninck, a sixth-generation member of family business and global chemistry giant Solvay, and Chief Revenue Officer of Trusted Family, a digital platform designed to improve communication, engagement and alignment among multigenerational family businesses and the way family businesses and family offices operate.

Canadian Family Offices recently sat down with de Coninck as Trusted Family prepares to further expand into Canada and the U.S. to learn more about how the Belgium-based company is using technology to enhance human connection and strengthen family ties behind some of the world’s leading multigenerational family businesses.

*Note: responses have been edited for clarity

What was the genesis of Trusted Family?

In 2007, Edouard Janssen and Edouard Thijssen, members of the Solvay and Aliaxis family businesses, identified the need for our own respective families to better organize our governance to help strengthen our communication, alignment and support effective operations across the family business, office, council, committees, foundations, and the different family branches. It’s really important for family members to stay informed about what the family, the business, and family office is doing to be successful in the long run. As families grow and disperse geographically, that’s harder to do. That’s what got us to develop Trusted Family for other families. We felt there was a huge need for the family offices industry to professionalize, create more transparency, better communicate and operate in a unified way that aligns family stakeholders across generations.

How has Trusted Family evolved?

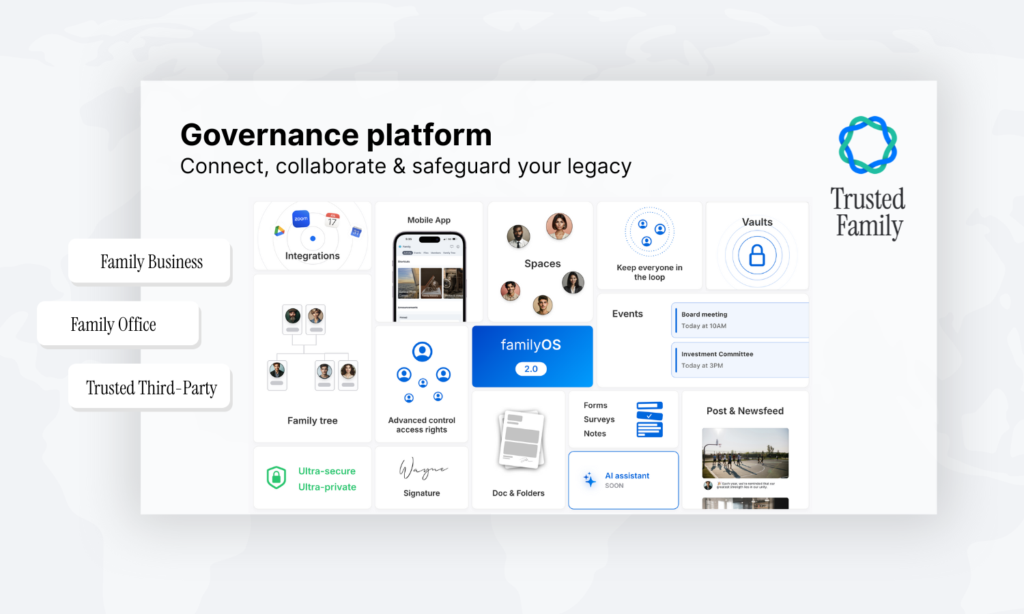

There are three aspects to Trusted Family’s solution: familyOS, familySuccess and familyCommunity. FamilyOS is our online platform. It offers a secure space to collaborate, store and share everything from family stories to board packets, financial statements and confidential documents, and to plan, schedule and follow up on meetings and events. Keeping family members accountable is one of the biggest challenges because you don’t hire your family members. You need to learn how to work with them and that requires professionalism and professional tools. When we sign a client, we have a dedicated client success manager throughout the journey. They help ensure the platform is tailored to best meet their specific goals in the way they operate.

What is the family trying to achieve? What are their priorities? Long-term goals. Focusing on the right use cases of the platform for each family is paramount. The third aspect of Trusted Family is the community we’ve built. We work with more than 200 families in 34 countries. The goal is to collect and share their best practices and learnings so they can learn from one another. It’s been a great success.

Is there a standout feature clients highlight?

Our smart, automated vault distribution feature has become a game changer for family offices in Canada. It allows users to seamlessly assign and distribute financial statements and other documents and information to the right individual on the platform based on name codes.

It saves a lot of time. Next-gen users also like our family tree and family stories and histories feature.

What sets Trusted Family apart from competitors?

A lot of Software as a Service companies in the family office space focus on the financial aspect. We are not a wealth management solution. We focus exclusively on human capital – the family, the next generation and family governance. We help families communicate and work better together and align and engage with everyone across generations. When you speak to the families, the struggle of informing and engaging is unique depending also on the persona.

Investing in a secure, centralized platform to manage governance, communication, and document sharing is essential for today’s family offices. With the right technology, families can strengthen engagement, foster transparency, and ensure a seamless generational transition – empowering both current leaders and the rising generation to thrive together.

Trusted Family Client, Melinda Rogers Nixon

How do you keep the third-, fourth-, fifth-generation interested in and engaged with the family office? How do you educate the rising generation on what they can do to make their own impact, have their own footprint and develop as a family? For us, the best success is when a patriarch or matriarch of a family calls us and says Trusted Family helped make succession seamless because everyone was interacting. Senior family members share stories and experiences, and the rising generation are able to research their family history and cultivate themselves at their own pace based on their desired career paths – all in one central, secure space.

Another key differentiator is the community we have built among our clients who are sharing their experiences and learnings with each other. AI will never be able to replace a community and the knowledge that each of these families has within themselves. That is where Trusted Families is doubling down.

How do you think AI will impact the Family Offices space?

I think AI has the same capacity for disruption as the world wide web when it was created 35 years ago, only it will happen much faster. The impact and opportunities for business will be huge. My biggest recommendation for family offices is to remain curious and try as many relevant AI tools as possible to learn from them. At Trusted Family, we use AI tools in our day-to-day processes to improve productivity, keep progressing and provide more value to customers, although it’s not yet integrated into the platform. It’s important to be cautious as AI is still in its early stages. For us, the most important aspect is security and maintaining the integrity of the information.

What new features are in the works?

Every quarter we release a new product roadmap for our customers, so they have visibility into what we’re working on. One of the key areas we are investigating is how to integrate and work with third-party providers used by our family offices. We are a very easy-to-use platform, but we need to be able to plug into other infrastructures our customers are using so that they don’t have too many tools.

This story was created by Canadian Family Offices’ commercial content division on behalf of PBY Capital, a member and content provider of this publication.

PBY Capital Limited is registered as an exempt market dealer, portfolio manager and investment fund manager with Canadian provincial securities regulatory authorities, servicing family offices and their professionals. For more information, visit: www.pbycapital.com. The opinions and information provided in this article are solely those of the writer and are not to be construed as personal, legal, accounting, taxation, or investment advice, or as an endorsement of any entity.