2024 was a strong year for credit, but a repeat performance in 2025 is going to be difficult. To capture the 7.4 per cent yield of the U.S. high yield market, investors need to push further down the credit curve into lower quality issues. As the team at leading Canadian institutional investment management firm Canso Investment Counsel wrote in their latest Corporate Bond Newsletter, it is as important as ever for investors to understand the risks on which you are lending. In this market environment, outside of special situations, the Canso team continues to favour quality and liquidity.

Click here for the full Corporate Bond Newsletter.

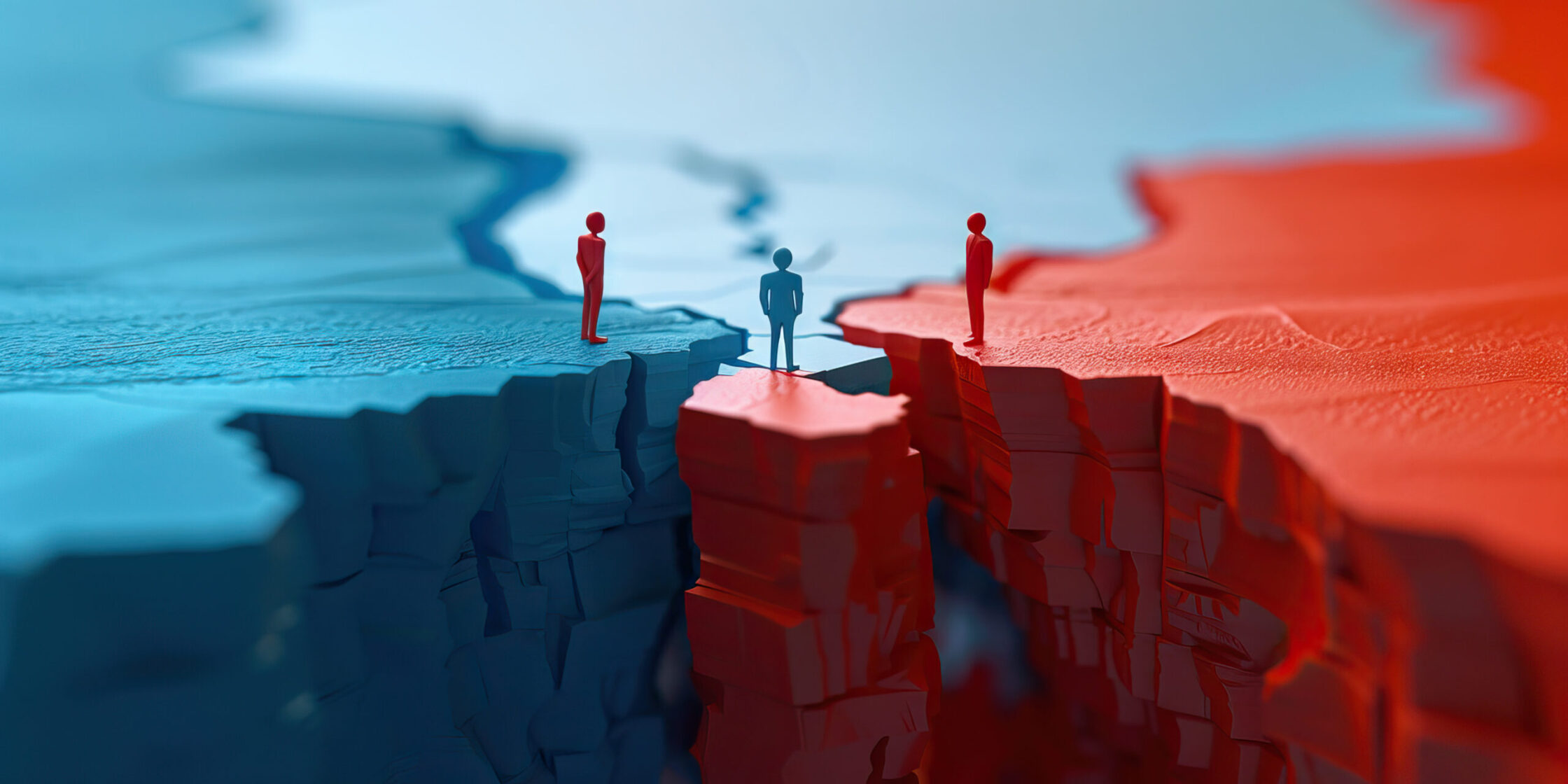

Who Wins the Fifty-Fifty? The U.S.

The Canso Investment team published its January 2025 Corporate Bond Newsletter the day after the Bank of Canada (BOC) implemented its first rate cut of 2025. This latest cut followed two consecutive 50 basis point (bps) reductions in the previous quarter, leaving the overnight rate in Canada, which started 2024 at five per cent, now at three per cent.

“The 200 bps cumulative decline over the past 8 months is double the speed of U.S. easing, leaving both our overnight rate and our currency much lower,” the newsletter noted, adding that since the U.S. Federal Reserve implemented its first cut on Sept. 18, the U.S. long-term bond yield has actually risen one per cent. “In price terms, this represents a 15 per cent decline. The offsetting moves at the short and long ends of the yield curve erased a yield curve inversion that existed for more than 2 years. The Canso team points out that the resilience of the U.S. economy has both the Fed and bond investors re-evaluating the future path of interest rates, sending longer term bond yields higher.

This is not to say that bond investors are optimistic. In fact, the bond markets are rightfully wary about the inflationary impact of tax cuts and tariffs repeatedly threatened by the new U.S. administration. The latest threat made post-haste before the Superbowl on February 9, 2025, is a 25 per cent import tax on all steel and aluminum entering the U.S. (as of February 11, those measures will take effect March 12).

“While equity markets met the election of U.S. President Trump with approval, bond markets weren’t so sure. It was a more challenging period for U.S. fixed income markets as government yields repriced higher. Capital appreciation from shrinking risk premiums in corporate bonds helped to offset the impact,” the newsletter pointed out.

The Canso team was surprised by the widening spread between U.S. and Canadian government bond yields. “Canso was founded in 1997. Prior to this time, the U.S. long bond yield had always been lower than in Canada. But for the past 28 years, the inverse has largely been true,” according to the newsletter. Might this be due to Canada having a higher credit quality? A more robust economy? A firmer control on inflation? “Our response to these points would be, ‘Unlikely.’ In our view, this Canadian premium (or discount depending on how you view it) is not based on fundamentals. If the Canadian economy experiences further weakness, we believe there is underappreciated risk to long Canada yields, especially relative to U.S. levels,” the authors wrote.

Canadian Corporate Bonds Aren’t Screaming Value

On the corporate bond side, the Canso team points out that lower quality BBB-rated issuers were the top performers in Canada, with spreads tightening 54 bps in the year, well ahead of A-rated issuers at just 20 bps.

Investors increasingly added credit risk in pursuit of the additional yield on offer in lower quality BBB-rated opportunities. The newsletter highlighted the example of Canadian grocer Metro Inc.’s new issue of a 5-year senior unsecured bond in November at a credit spread of 81 bps. Despite the fact that this is the tightest 5-year BBB spread on record, the order book was more than four times oversubscribed. “Shifting out the curve, the long bonds of BBB rated issuers have for many, tightened inside the 200 bps spread level. Not exactly screaming value in our estimation,” the Canso team wrote.

Meanwhile, another top performer of 2024 was Limited Recourse Capital Notes (LRCNs), issued by Canadian banks and insurance companies and ranked below senior and subordinated bonds, in line with preferred shares. “A comeback story, these securities regained lost ground following significant declines over 2022-23. Within this subsegment, there was a marked outperformance of “low reset” issues versus “high reset” peers,” the Newsletter observed.

Higher Risks for Lower Yields

The Canso team points out that the appetite for credit risk also extended into the more speculative ends of credit markets, where high yield spreads continued to move tighter during the final quarter of 2024.

“High yield bond issuers sought to take advantage of the historically tight risk premiums in the new issue market. Tighter credit spreads resulted in lower borrowing costs for most issuers. In 2024, more than US$280 billion was placed in the market, which is more than the combined annual totals in 2023 and 2022. This total remains modest relative to the unprecedented amount of issuance during the pandemic-era,” the newsletter noted.

Unsurprisingly, lower borrowing costs and accommodative markets resulted in significant issuance to support refinancing of outstanding debt. “However, the new issuance volumes, net of refinancing, were once again quite modest this year,” the team wrote. “This means that there was limited new supply placed in the market and yield hungry investors continued to accept less compensation for their investments.”

However, the team warns that after another strong year, a repeat performance in 2025 is going to be difficult. To capture the 7.4 per cent yield of the U.S. high yield market, investors need to push further down the credit curve into ever lower quality issues. As it stands, the newsletter noted, “Investors are receiving less extra yield for the incremental credit risk. We believe that reaching for yield is always dangerous and that at current valuations, investors should be focused on a discriminate approach to ensure compensation for credit risk. We are not confident that will be the case.”

Investors Should Understand Risk

The Canso team sees plenty of warning signs in credit markets. The low rate of defaults that is providing confidence to investors sits against a continuing rise in liability management exercises “LMEs” or “Distressed Exchanges”. The same deal structures that provided flexibility for LMEs in the past are present in a high percentage of issues still outstanding today. This illustrates credit stress below the surface. “We are steadfast in our belief that it is as important as ever to understand the risks on which you are lending. At current valuations, the upside is likely your running yield and the potential for very modest additional spread compression. The downside, on the other hand, is significant,” the team wrote.

In this market environment, outside of special situations, Canso’s approach is simple: favour quality and liquidity, until and unless you are compensated for the risks.

Disclaimer: This story was created by Canadian Family Offices’ commercial content division on behalf of Canso Investment Counsel Ltd., which is a member and content provider of this publication