What is a “real” multi-family office? What is the role of an MFO in managing investments for ultra-high-net-worth clients? (And what does “ultra-high-net-worth” mean, anyway?) Are MFOs client-aligned stewards of wealth, or more like fund distribution outlets? And how has the disruptive, unprecedented, weird and wild state of the global economic landscape and all-important Canada-U.S. relations affected how and where family offices are investing their clients’ capital?

In short, we have questions—as, we think, does anyone who follows the rapidly evolving multi-family office ecosystem in Canada.

To find some answers, Canadian Family Offices last year published our first-ever MFO study, based on a survey of firms across the country about their services, size and history, as well as investment priorities, challenges and opportunities. This year, to develop a broader and even more relevant picture of the industry, we have built on those insights to develop The Multi-Family Office Landscape in Canada 2025 report, which will be released exclusively to newsletter subscribers next week, well ahead of the general release next month. (You can sign up for our newsletter here to make sure you receive your advance copy.)

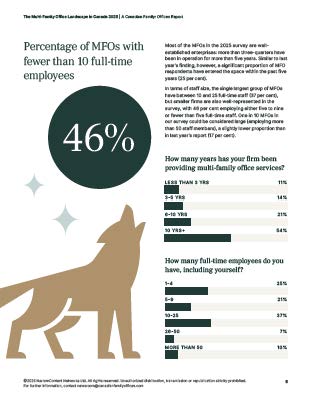

Based on survey responses from nearly 80 MFOs across the country, The Multi-Family Office Landscape in Canada 2025 once again asked MFOs about their size and tenure, as well as their location, number of clients, areas of concern and recommended asset classes for portfolio allocations. But this year’s study probes deeper than last year on several points, including with questions that we hope lend perspective to a long-standing debate within the family-office industry—namely, what constitutes a “true” family office in the context of MFOs.

To address that, this year’s study takes a more detailed look at client net worth. Is the number $50 million? $30 million? $15 million? That’s a key question for those who define “true” family offices by the wealth of their clientele. Our survey also poked at another point of debate within the industry: How do MFOs balance clients’ interests with the imperative to generate profit? One aspect of that debate is how they approach investment management—that is, whether they solely provide advice (a “pure” or open-source model) or effectively “sell” proprietary or third-party funds to clients. Our survey results on that issue might surprise (and gratify) some readers.

There is plenty of other intriguing data in this year’s study, including a look at ownership of MFOs, the relationship between MFOs and single-family offices, MFOs’ top concerns (hint: the biggest one isn’t tariffs), and where firms intend to allocate client capital globally as the geopolitical and trade landscape shifts. Without giving away details, we found that—surprise, surprise—the world is indeed changing and MFOs are changing right along with it.

Of course, this year’s study does not claim to have all the answers, but we hope that it at least asks some of the right questions. We also hope you find it an interesting and worthwhile read.

Remember: we are making The Multi-Family Office Landscape in Canada 2025 available to newsletter subscribers exclusively next week, before its wider release later this year. If you have not already signed up for our twice-weekly newsletter, we encourage you to do so.

Please visit here to see information about our standards of journalistic excellence.