When we conceived of Northwood Family Office in the early 2000s, I joke that our first “office” was a table in a Montreal deli. That’s where my co-founder Scott Hayman and I sketched out a radically new idea on the back of a paper placemat: a family office model that didn’t exist in Canada and that was unbound by product pitches, siloed advisors or transactional thinking.

At that time, the phrase “multi-family office” barely rippled in Canadian wealth circles. (More than a handful of people asked me if it had something to do with birth control and family counselling.) Having come from RBC Wealth Management, I knew what family offices looked like overseas, but Canada had virtually none in those days.

My own family had been hunting for truly objective, integrated advice and couldn’t find it. They say the best entrepreneurs are frustrated consumers, and this led us to build Northwood for ourselves and open our doors to others who were looking for the same boutique, holistic service.

Sitting around that table at the deli, I remember the clarity of our purpose: our firm would serve as a trusted “general contractor” or “orchestra conductor” for a family’s net worth: coordinating and integrating investments, tax, philanthropy, governance, administration and even family dynamics. And now, of course, the term “multi-family office” is rampant and growing—and spawning a whole range of providers, some “real” MFOs and some not.

Our breakthrough came with our first client in 2003—a family who had recently sold a business for a substantial sum. They trusted us to build a family office for them and have been with us throughout Northwood’s entire journey of 22 years. Working with them and other clients over the years helped shape our approach to family wealth management, which treats wealth as a living system, not a collection of products. We formalized integration, accountability, fiduciary independence and getting things done.

The world evolves—and so did we

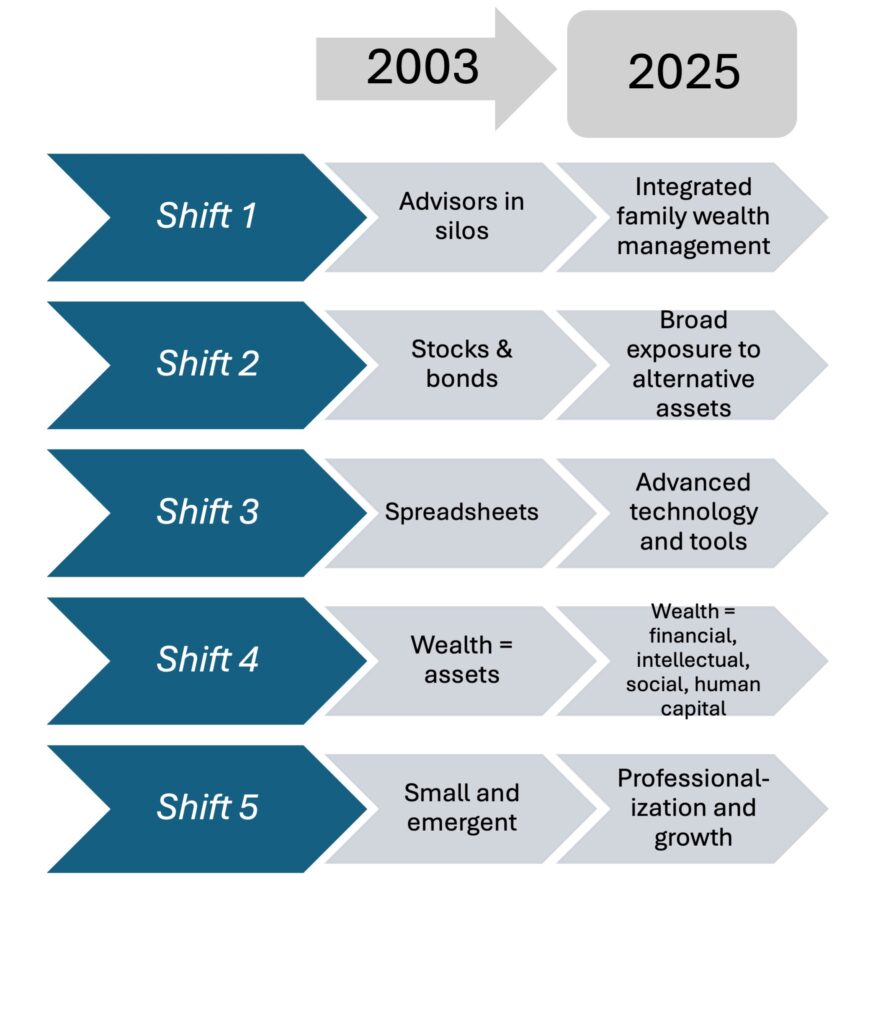

Of course, things change, and we (and the entire family office industry) have adapted and enhanced services along the way. Here are some of the major developments in family offices over the past 20-plus years.

Shift 1: Siloed providers to integrated advisors

Substantial wealth can be a tremendous advantage for families, but it also creates its own set of complex interrelated challenges, the scope and pace of which only seem to be increasing. Families need new tools and approaches to address these issues and are increasingly looking for advisors who are up to the challenge of helping them navigate this complex landscape. McKinsey data and UHNW Institute research indicate a striking shift: more than half of wealthy clients now prefer integrated solutions over standalone siloed service providers. They seek strategic partners who can connect the dots across domains and generations.

Back in 2003, there were few providers that offered an integrated service model. The big shift is that, for many firms, integration has now moved from optional to mandatory.

Shift 2: From stocks and bonds to alternative assets

In 2003, the menu was largely public equities and fixed income. Alternatives were niche. Today, private equity, venture capital, real estate and infrastructure are staples in client portfolios. Through the years, we built both internal staff and trusted partner networks to support clients navigating those assets, with a continued commitment to independence and objective alignment.

Shift 3: From simple statements to advanced technology and tools

Early on, we (and most firms) tracked family holdings via spreadsheets and collected documents in binders. Now, we deliver state-of-the-art reporting, a whole series of customized tools (for capital calls, estate planning, philanthropic decisions, major purchases, etc.), and an online portal for sharing confidential information among clients, their external advisors and ourselves.

Shift 4: From financial capital to human capital

Initially, we focused on goal setting, wealth planning and investment management. Over time, we learned that even more significant risks can occur when families neglect values, identity and purpose, when they can’t communicate effectively with each other, and when they aren’t able to prepare the rising generations for what’s to come.

Today, we facilitate family councils, coaching programs and philanthropy that helps knit generations together, not just distribute capital. This is increasingly common in the industry, whether offered through in-house expertise or outsourced to specialists.

Shift 5: Professionalization amid growth and consolidation

In the early days, family offices emerged based on the needs of complex families that became apparent to a few unique professionals (mostly CPAs and lawyers) who understood why client activities needed to be integrated and who had the experience to do so. They were bespoke and boutique.

As client wealth and complexity have grown over the past 20-plus years and the family office concept has become better understood, the demand has exploded. Many firms have realized their need for broader and more varied (and sometimes more global) services for their families and the need for professionalization in their service offering. It may no longer be possible for a well-meaning and experienced CPA, for instance, to provide this integrated advice off the corner of their desk. There is also some early movement toward accreditation and industry standards, which will help bring clarity for client families who are looking for a specific solution.

At the same time, capital providers have been attracted to this expanding business and have been building and buying in this attractive sector and also providing liquidity for early founders of family offices. Of course, the key is the ability to maintain high local service standards, operational independence and ownership by staff while expanding services to clients and building financial strength.

Northwood has been a part of CI Financial and Corient for over three years now, and we have been able (and encouraged) to keep the business and client service exactly the same as it has always been. We’ve also been able to add a new crop of younger shareholders, which strengthens the firm and its long-term sustainability. Recently, CI announced a major global transaction (with the addition of Stonehage Fleming and Stanhope Capital) that will turn its wealth management business, Corient, into the largest multi-family office in the world.

Other firms like Pathstone and AlTi Tiedemann have also been consolidating and growing in the UHNW/MFO space, and others are trying to figure out the path forward that will be best for their clients and themselves.

Chart: The Evolution of the Family Office Industry

What remains unchanged—and why it matters

Even as the landscape has become more complex and the number of family offices grows, there are five fundamental principles that I believe should always guide the industry forward:

- Purpose first, portfolio second: Aligning investments with family goals and mission is critical.

- Integration over products: A family office must knit advice together, not sell it. If you’re tied to product sponsors, alignment can suffer.

- Objectivity trumps scale: The real differentiator is structural independence, not size or brand.

- Transparency wins trust: Data platforms and client access aren’t a luxury; they’re essential tools to building client trust.

- Rising-gen inclusion is crucial—and it doesn’t happen without intention.

Looking back from 2025, it’s remarkable how far the family office industry (including our own firm) has come since that first deli table sketch in 2003. I built what I needed for our family. We scaled what worked. We learned from successes and failures. And we stayed disciplined on our promise of unbiased, integrated stewardship. I believe we are still in the early innings of a revolution in the wealth management industry that will significantly benefit client families for decades to come.

My family is a client of Northwood Family Office. I still think like a client, but I also have the passion of a founder. And even after decades in this business, I’m still learning. The future demands more than ever our best thinking, strategic clarity, and our deep commitment to the families we serve.

Tom McCullough is founder and chairman of Northwood Family Office.

The Canadian Family Offices newsletter comes out on Sundays and Wednesdays. If you are interested in stories about Canadian enterprising families, family offices and the professionals who work with them, but like your content aggregated, you can sign up for our free newsletter here.

Please visit here to see information about our standards of journalistic excellence.