Client expectations are rising—a common theme we’ve been hearing throughout the year at Canadian Family Offices. The reasons are varied, from technological advancements to societal shifts, and even down to the simple fact that Canadians have more choices.

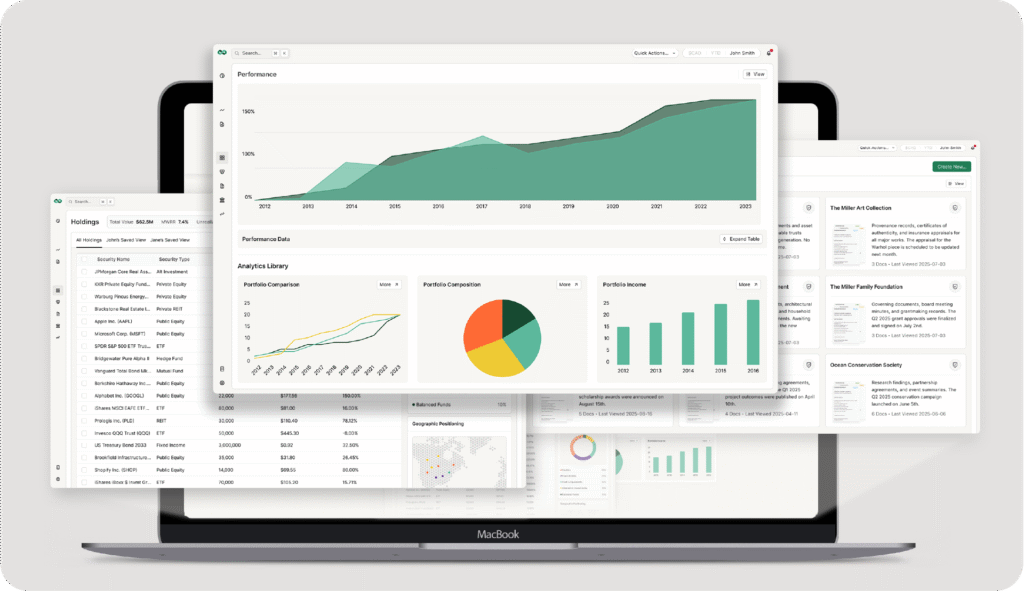

In the family offices space, portfolios are growing more complex with increased private asset allocations and diversification, and younger generations are becoming more engaged. Today families expect seamless, real-time visibility into their wealth, and that means investment professionals must be able to manage these portfolios efficiently.

Family offices are turning to technology to better aggregate data and improve reporting. PortfolioXpressWay President and CEO Dasha Smyth and CTO Josh Merchant examine the factors driving this trend and share their perspective on when it’s time to invest in technology.

Challenge #1: As family offices grow, manual systems stop scaling.

Excel can serve family offices well at a certain stage of growth. But as reporting frequency increases and more time is spent preparing for portfolio discussions with family members, many may be ready to transition to a more sophisticated solution.

“At a certain point of complexity, spreadsheets stop scaling. Families want a holistic picture across private investments, operating companies, real assets, and associated documents—not ten different files stitched together,” Smyth says.

She adds that there’s a significant gap between understanding what’s happening across fragmented systems and presenting that information in a way that clients can easily understand. “Most clients want to know the answer to a simple question: ‘What’s my net worth?” and that question should never require a week of work to answer.” Technology should turn what would have once been a major project into a click.

This manual burden doesn’t just slow operations; it also introduces risk. Errors, inconsistent controls, and unsecured files create vulnerabilities that become harder to manage as new assets and accounts are added. The need for better security can signal that Excel and fragmented spreadsheets are no longer sufficient.

“As multi-family offices grow, they become more attractive to attackers,” Merchant says. “They need to be conscientious about the way in which information is protected, because their size makes them targets.” It’s at this stage that investing in more robust, purpose-built technology becomes essential to safeguard sensitive data.

“Security can’t be an afterthought. As family offices grow, so does the expectation that sensitive information is protected by institutional-grade controls,” Smyth adds.

Challenge #2: Technology is becoming a competitive necessity for clients.

Family offices aren’t just dealing with operational inefficiency; they’re responding to a shift in client expectations as well. Families want real-time clarity, secure access to their information, and a digital experience that matches the sophistication of their wealth.

“Client-facing technology is becoming a competitive differentiator. Families choose the firms that provide clarity, transparency, and a modern experience.” Smyth says. She adds that this is especially true as wealth is transferred to the next generation of family members.

While G1 and G2 family members may remain satisfied with traditional reporting methods, a monthly and year-end report may no longer be satisfactory for a new generation of family members.

“We’re seeing a clear shift from ‘static reports’ to ‘interactive insight.’ The next generation wants to understand the drivers of their portfolio value today and future projections, not just receive PDFs.” Smyth says.

As markets move, clients expect their advisors to move with them and that requires technology that updates as quickly as the world does.

“The real value is getting all the data — the assets you manage, the assets you oversee, and the assets the family tracks privately — into one place so that you and the client can see everything in real time.” Merchant says.

Sophisticated platforms can also offer selective access to the system for various family members, allowing for discrete views of family wealth according to the family’s wishes.

Challenge #3: Top tier investment professionals demand modern tools.

Beyond satisfying families, technology also shapes how family offices operate, directly impacting productivity and talent retention. Without modern tools, even the most talented hires end up spending valuable time wrestling with fragmented data, manual processes, and inconsistent reporting.

“If you want to hire a brilliant investment advisor, that person will come in and ask, ‘Where are my tools?’” Merchant says. “If you want the talent, you need to be willing to invest in the bench to be able to give those investment professionals the ability to do their jobs the most effective way that they can. We still see a disconnect on that concept in the market,” he adds.

Reducing the operational burden and standardizing information allows teams to spend more time on strategic work rather than administrative cleanup.

“Family wealth is multi-dimensional — operating companies, fund investments, alternatives, real assets. Technology should be the unifying layer that brings that complexity together into a coherent story for investment professionals,” Merchant says.

Ultimately, offices that invest in the right technology not only empower their teams to perform at a higher level but also position themselves for the next generation of talent.

As portfolios, expectations, and risks rapidly evolve, family offices need technology that keeps pace. In the end, upgrading the tech stack isn’t just an operational decision; it’s a commitment to delivering the clarity, security, and experience families expect.