The stock market currently exudes greed. And that should worry savvy investors.

Indeed, one of Canada’s leading portfolio managers for ultra-high-net-worth families is among those wealth professionals who see abundant risks in equity markets as the S&P 500, the NASDAQ and even the TSX Composite Index continue to achieve new highs.

“The alarm bells are ringing loudly,” says Thane Stenner, founder of Stenner Wealth Partners+ at CG Wealth Management and Chairman Emeritus of ultra-high-net worth (UHNW) network Tiger 21 in Canada. He previously held award-winning consulting roles at Morgan Stanley/Graystone Consulting, based in California as Managing Director, International Client Advisor, Institutional Consulting Director, Alternative Investments Director and Portfolio Manager. He also hosts “Smart WealthTM with Thane Stenner,” a BNN Bloomberg podcast.

A money manager for families with net worths ranging from tens of millions to billions of dollars, Stenner is a veteran investor and advisor, who has heard renditions of this siren song of surging markets before.

Surging markets should make family offices leery too, and they should be considering taking profits and risk out of the surging public equity sleeves of their portfolios to prepare for the inevitable return of a bear market.

Thane Stenner

Below, Stenner discusses three market charts that make the case that markets are nearing a high watermark likely to be followed by a decline in pricing across the board.

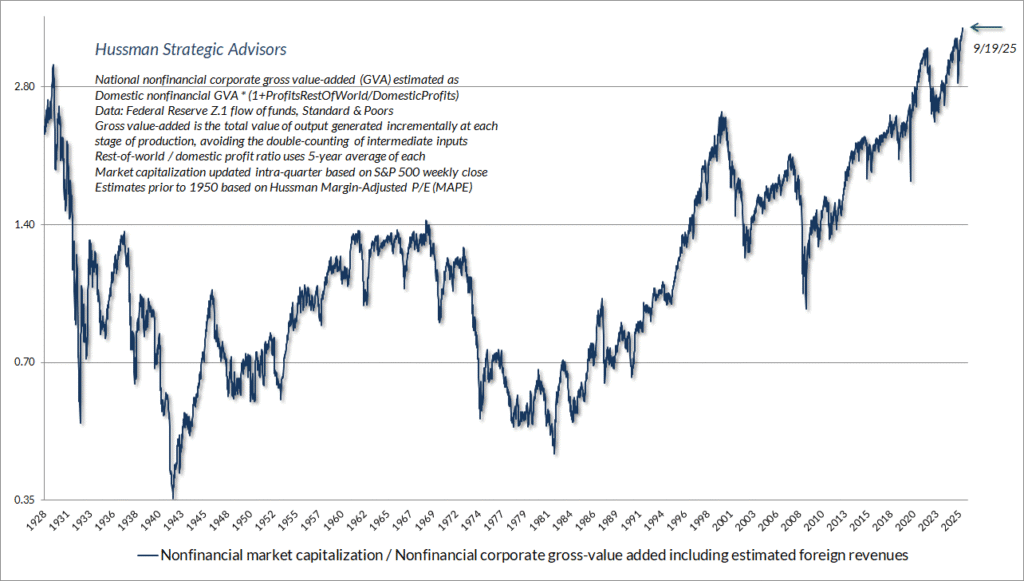

Sky-high valuations

This chart of the historical margin-adjusted price-to-earnings ratio (MAPE) from Hussman Strategic Advisors — a well-known and respected investment firm —shows just how bubbly the current U.S. stock market has become. “We are in the 99th percentile of historical valuations going back almost 100 years,” Stenner says.

Notably, valuations are at their highest point dating back to before the 1929 stock market crash that triggered the Great Depression. The chart also shows that today’s valuations are higher than the Dot-com Bubble, which bears many similarities to today’s current artificial intelligence mania.

“Back then, everyone knew the internet would be huge, and it did eventually change everything, but a lot of those high-flying tech companies of the day got crushed, and many are no longer around today,” Stenner says.

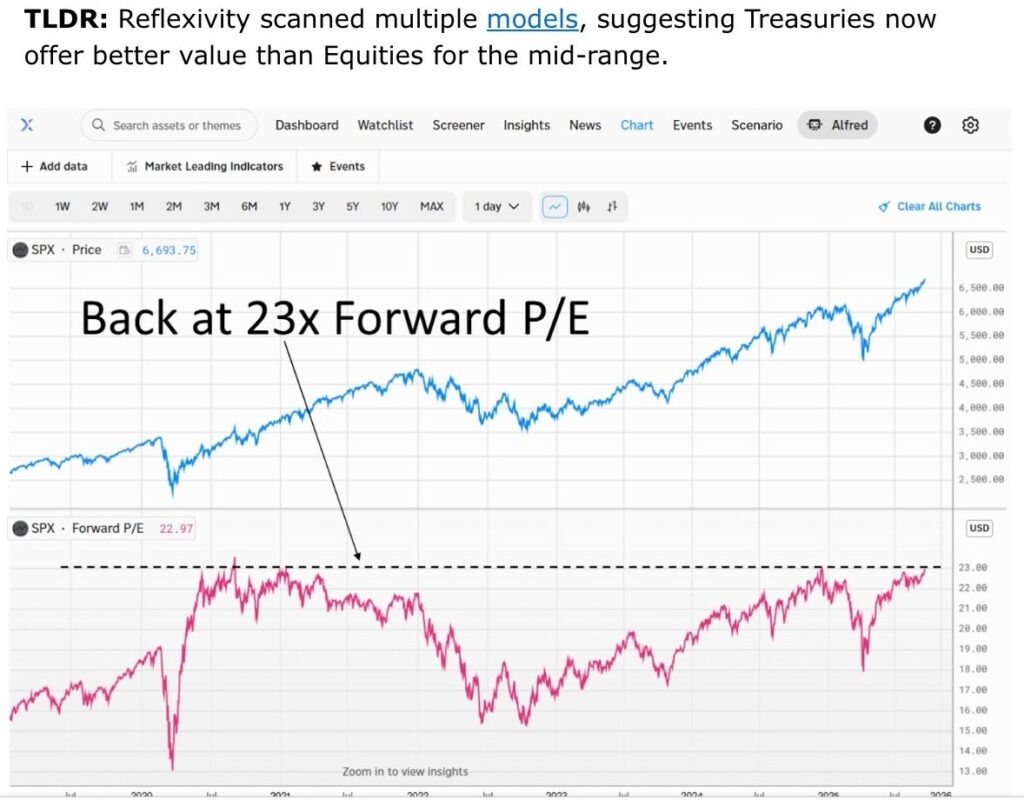

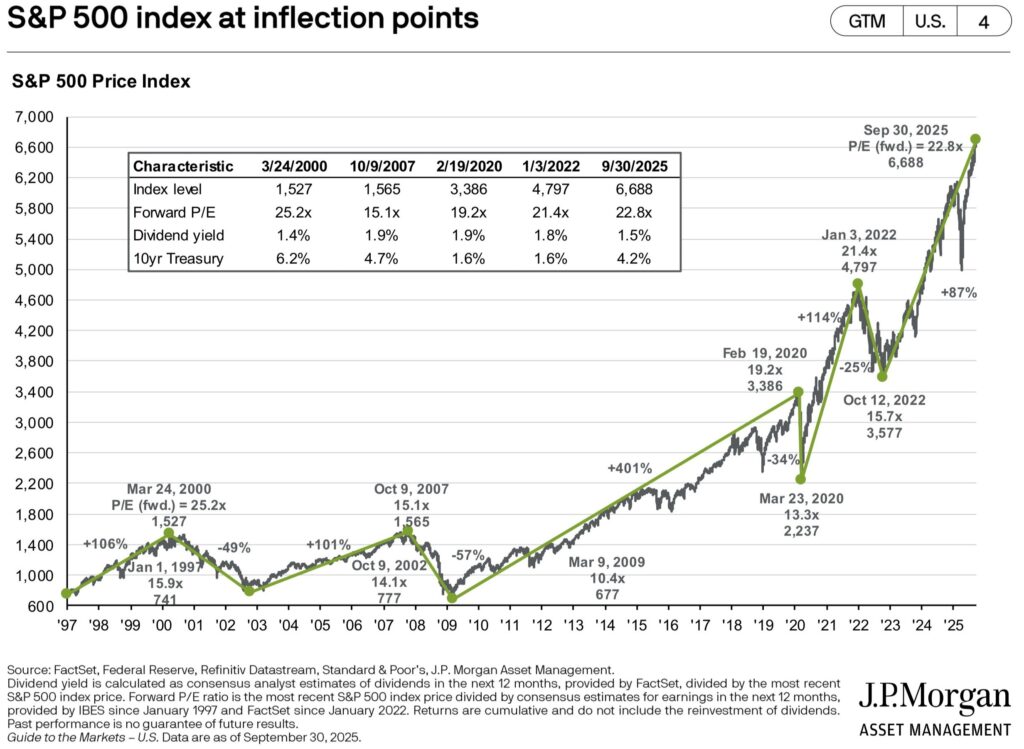

Animal spirits running wild

Here a price-to-earnings chart shows how the S&P 500 is at its highest valuation since the pandemic stock market frenzy powered by low interest rates. Today, however, it is AI dragging markets higher with investors piling into the belief that the technology, much like before the Dot-com crash, will lead to a new golden age (to use the parlance of United States President Donald Trump) of corporate profitability and economic growth. That may turn out to be true, long-term, he adds.

“But the current sky-high valuations really illustrate how the animal spirits are alive and well.” By ‘animal spirits,’ Stenner is referring to a term first used by economist John Maynard Keynes describing how economic decisions are often driven by emotions.

Undoubtedly, markets today are deeply driven by near ecstatic greed, he adds.

You could say it’s super risk-on in markets right now with investors willing to pay a premium for AI stocks like Palantir Technologies and Nvidia Corporation.

“It’s flat-out irrational exuberance just like past bubbles—only AI-driven this time around.” Even Sam Altman, CEO of OpenAI—the private company behind ChatGPT—has been quoted recently that he believes AI is in a bubble.

“Here’s a guy with billions of personal wealth tied to this, but even he is stating things have gotten crazy,” Stenner notes.

What’s more, financing activity in the tech sector today bears similarities to financing during the Dot-Com boom before the crash, Stenner says. Case in point is that, in March, Oracle has announced it is investing $40 billion in Nvidia. Then more recently, Nvidia revealed it would invest $100 billion in OpenAI. The next day, OpenAI announced it is investing $300 billion in Oracle.

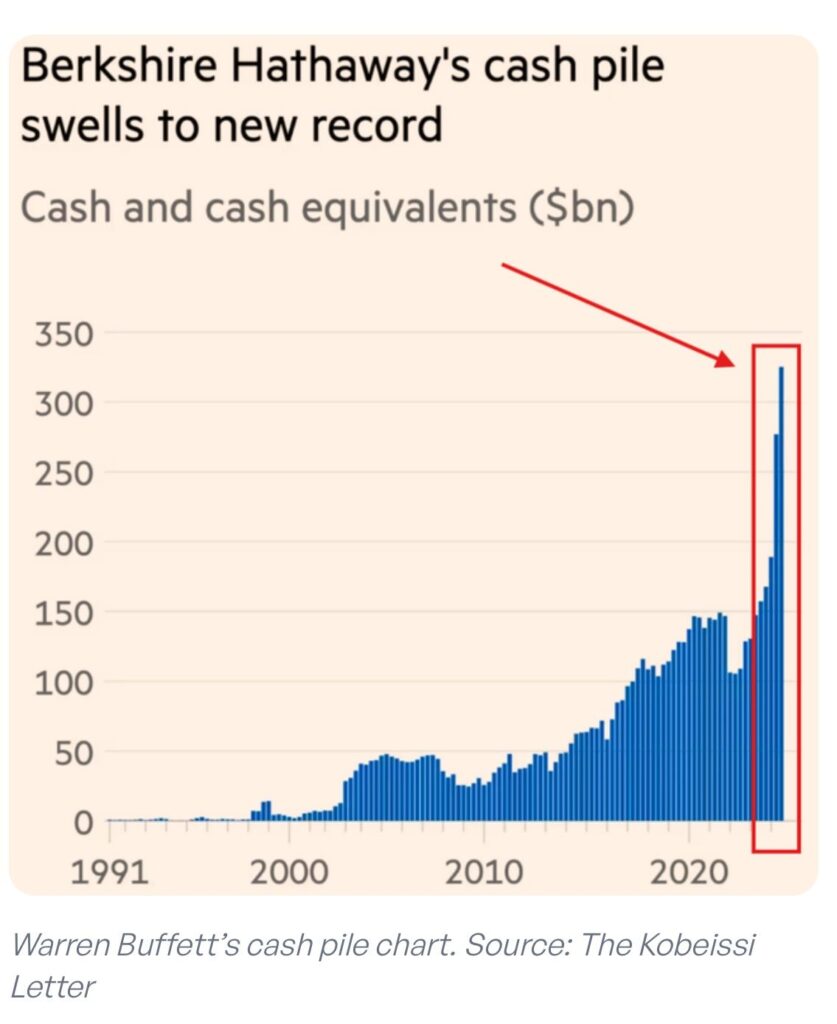

The Buffett signal

Warren Buffett is renowned for saying he doesn’t time markets. Yet the world’s most famous value investor certainly does not consider the time is right to invest in great companies at reasonable prices or, even better, at a discount, Stenner says.

Notably, the chief executive officer of Berkshire Hathaway has largely been on the sidelines amid the current buying frenzy that began after Liberation Day in April. Yet Stenner notes that Buffett, despite his protests to the contrary, is actually very good at recognizing when markets are at their peak and poised for a dramatic downturn. “Somehow, Warren Buffett always raises significant cash reserves at Berkshire Hathaway right before markets meltdown.”

Indeed, this chart shows Berkshire Hathaway now has nearly $350 billion of its assets in cash or near cash equivalents. That is the firm’s highest allocation ever to cash in its portfolio. “If you study his moves, with his cash position now at 30 per cent, it suggests that, based on previous history with his strategy, that something is going to crack.” What’s more, Stenner notes that in previous periods of surging markets, Buffett has appeared seemingly out of step with exuberant investors, at least in the shorter term.

“In the last 35 years, the number of times I’ve seen Warren Buffett’s acumen challenged is almost comical.” Pointing to his recent LinkedIn post linking to a December 1999 Barron’s article with the headline,’ Whats (sic) wrong, Warren?’, Stenner notes how it illustrates Buffett’s astute contrarian stance when equity investors become irrationally greedy. Indeed, the Barron’s feature discusses his misgivings about Dot-Com valuations about two and a half months before the bubble burst and the NASDAQ, for example, lost more than 76 per cent of its value. “It happens again and again with headlines suggesting Warren has lost his touch.” Of course, history shows Buffett has continually proven his critics wrong.

A wake-up call

Family offices should heed the overvaluation risks building in equity markets today and consider taking some meaningful profits off the table, as well as de-risking/hedging their existing portfolios. Like Berkshire-Hathaway, build a large cash reserve to take advantage of equity buying opportunities that will inevitably emerge when markets do decline with great companies’ share prices going on sale, Stenner says.

“You never know exactly what the pin prick will be that pops the bubble.” He further points to meeting legendary value investing pioneer Sir John Templeton once and discussing market bubbles. “He said to me that there are certain things that are known, like valuations, but the specific elements that spark the eventual decline you just can’t precisely predict at least in the short run.”

Templeton’s words indeed resonate today, Stenner says. “Maybe it’s two days, or six months from now. We don’t know, but all the indicators are there of a market at its peak. There are still investment opportunities globally, but raising some cash or hedging here like Warren is probably a smart move.”

*Responses have been lightly edited for clarity and length. Mr. Stenner’s viewpoints within this interview were submitted to CFO on October 9th/2025.

Disclaimer: This story was created by Canadian Family Offices’ commercial content division on behalf of Stenner Wealth Partners+ at CG Wealth Management, which is a member and content provider of this publication. CG Wealth Management is a division of Canaccord Genuity Corp., member of CIPF and CIRO. Tax & Estate advice offered through Canaccord Genuity Wealth & Estate Planning Services Ltd. Thane Stenner’s views, including any recommendations, expressed in this article are his own only, and are not necessarily those of Canaccord Genuity Corp.

Follow Thane Stenner and Stenner Wealth Partners+ on LinkedIn.

Thane Stenner Interviews/Articles, Member of Canadian Family Offices.

About Stenner Wealth Partners+

Stenner Wealth Partners+ (SWP+) is an in person/virtual Multi-Family Office/Outsourced CIO Consulting team of financial/wealth specialists with a boutique approach and global perspective. SWP+ serves Canadian and US investors/households with generally a minimum of 10M+ in investable assets or 25M+ net worth. As a CG Wealth Management team, SWP+ is a highly exclusive practice team with one of Canada’s largest independent wealth management firms. Client Range of Net Worths: between $25M To $3B+. They strategically limit new client engagements, onboarding only six to eight new key relationships annually to ensure a highly personalized and focused approach. SWP+ is a member of Canadian Family Offices.

About CG Wealth Management

The global wealth management business is entrusted with C$125.3 billion in client assets1. The wealth management operations of the Canaccord Genuity Group (CG Wealth Management) provide comprehensive wealth management solutions and brokerage services to individual investors, private clients, family offices, Donor Advised Funds (DAFs), and intermediaries through a full suite of services tailored to the needs of each client.

1Canaccord Genuity Annual Report, June 30, 2025